Planning For Retirement

There comes a time in every person’s life that they have to begin to seriously start thinking about retirement.

Investment professionals would advise that this age be in the early twenty’s.

It takes time to save for retirement and even though 65 may seem like a long time away, it can be upon you before you realize it.

And a sad fact is that Social Security is not going to be enough to get you through your Golden Years in a comfortable lifestyle.

That is why investing in a 401K is so important. This is something that all United States citizens need to be contributing to so that they can retire at a reasonable age and not have to worry about making ends meet when they do eventually retire.

Retirement terms can seem confusing but that is where this page comes into play. It can help answer the basics of 401k’s and hopefully give you the guidance you need to come out on top.

What Is A 401K?

A 401K is basically a retirement plan where people contribute part of their pre-taxable income into an account that is usually set up by an employer.

This type of retirement plan is often one of the perks to working at a large corporation or business because the business will often match a percentage of the funds an employee puts in.

It allows you to save towards retirement without having to worry about taxes and it also lowers your take home amount each week so that you are taxed on less money.

And everyone likes to save money on their taxes. But with this form of retirement there are some very strict guidelines about how much can be put in at one time and when you can withdraw the money.

You also have to worry about changing jobs or losing your job and your retirement fund.

How Is Money Paid Into A 401K?

Most money that is paid into a 401K is taken out of your weekly, semi weekly or monthly paycheck before taxes are taken out.

It is put into a special fund that will draw interest or be invested.

You have to know how you want your money invested when you set up your retirement fund. Your employer will give you options when you first sign up.

If you happen to work for yourself, you can go over setting up this type of retirement plan with a financial advisor and investor.

The worst mistake you can make is not monitoring your investment and your fund.

There have been cases of mismanagement by employers and advisors so it is your job to stay informed and well educated. The use of “I didn’t know” just does not adequately protect you should something go wrong.

Is The Money Paid Into A 401K Taxed?

Technically this is a yes and a no type question.

Money that is taken from your salary and put into this special type of retirement fund is often taken prior to any withholding of taxes.

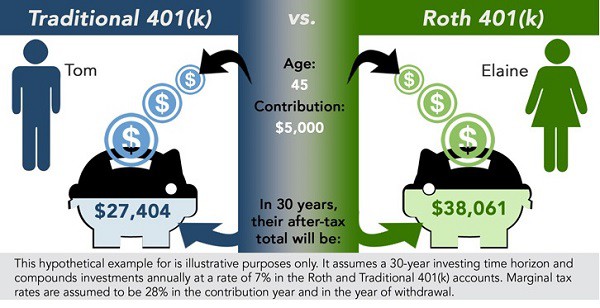

There is a special type of 401K called a Roth that does allow you to have taxes taken out. The reason is because you will not be taxed so heavily when you withdraw your money when it comes time to retire.

But the standard plan, while not taxing you when you put money into it, will tax you when you withdraw from the account. The earlier you withdraw your money the more you are going to be taxed.

What Is A Roth 401K?

A Roth 401(k) is a special type of plan that allows participants to withdraw money from their retirement plan without incurring heavy taxes.

But the reason for this is because the money was taxed prior to investing it. You do have to know, prior to setting up your retirement fund, what you plan to do with your contribution and how you want it disbursed. It is important to talk to your human resource contact or a financial advisor on which plan is most beneficial to you.

You also need to think about your funds and contributions in a long term manner. Not many people take a job and immediately think about quitting in the near future but layoffs, terminations and leaving a job does happen quite frequently.

When, or if, that happens to you then you need to know what is going to happen to your retirement fund through the company.

Do Employers Contribute To Employees’ 401k?

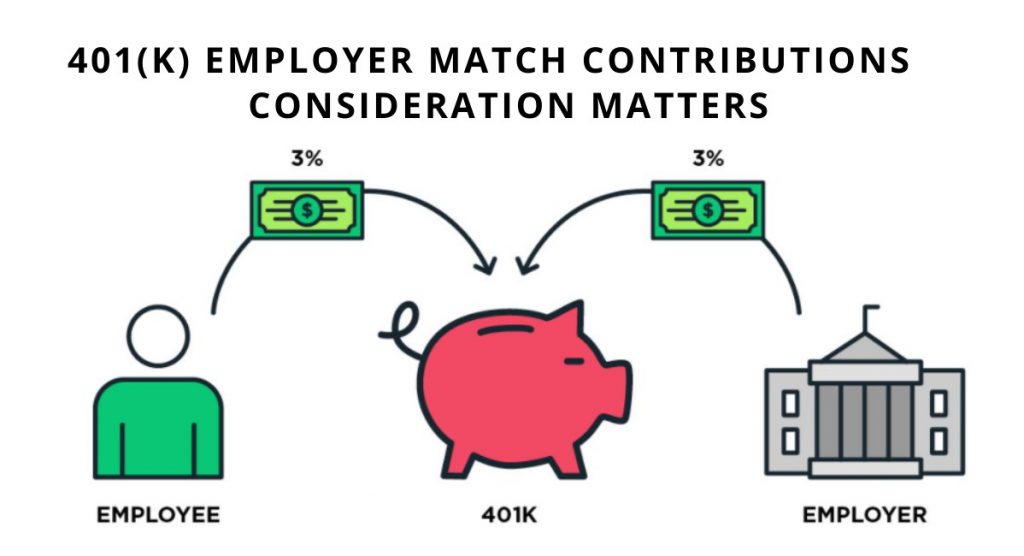

It is fairly typical for large corporations or employers to contribute some to their employee’s 401k plans.

They may offer to match the percentage that you put in. This is a fantastic thing because essentially you are getting free money just for investing in your future which you planned to do anyway.

But with the economy in such a downturn many employers are finding themselves financially unable to contribute or match their employee’s contributions.

This can be disheartening but you still need to put the money away yourself even if your employer is not contributing. It is not required by law that any employer, big or small, has to offer you a retirement plan. That is why it is considered part of a “benefit” package.

If My Employer Goes Bankrupt, Is My 401K Protected?

Unfortunately it does not mean that your 401K is protected. Take the Enron scandal as a great example.

The company bigwigs did not take out insurance on their employee’s retirement plans. And as a result many people lost their life savings.

The most important thing you can do prior to enrolling in a 401K offered by your company is to ensure that they have insurance that covers your money.

You do not want them to close the doors and take your money with them.

What Happens To My 401K If I Leave My Job For Another?

Luckily you do have some options if you leave one company and go to another.

You can always roll your 401K savings into the new company’s retirement plan or you can convert it to an IRA.

You can also withdraw the money but that should be a last resort option because you will be taxed very heavily.

How heavily will you be taxed?

You will be hit with about 55% in taxes and fees because you cashed out early before retirement.

The ideal situation is that you convert your money over into another retirement fund and do not lose any nor are you heavily taxed as a penalty.

Can I Withdraw My 401K Money Anytime I Wish?

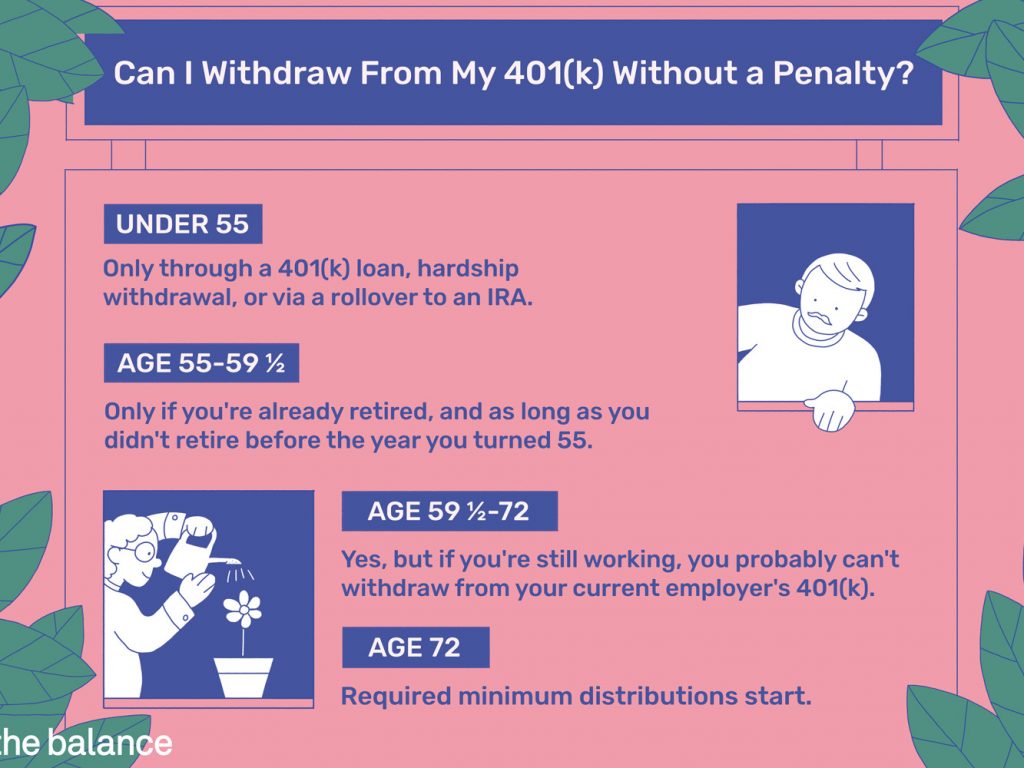

Yes, you can withdraw your 401K money anytime you wish but it is very, very unwise to do so.

Unless you are faced with extreme circumstances that require immediate cash, you should never do so before you hit the minimum retirement age.

The tax penalties on it are extraordinary and will reduce your available amount by over half!

There are other options such as taking out a loan against your retirement savings.

And even though you will still be paying interest and taxes on that loan it is not nearly as much as if you cashed in your retirement.

What is the age requirement for a 401K withdrawal without any penalty?

Most 401K’s allow you to start withdrawing funds from them without incurring heavy tax penalties once you reach 59 ½.

If you begin withdrawing before that they you are going to usually incur a 10% tax penalty on top of the regular tax that is paid each time you withdraw. That makes it an incentive to wait until you are at retirement age before withdrawing money.

The longer you can wait the more money you will save.

There are exceptions to this rule though. If the person dies, becomes disabled or loses their job a year before or in the retirement year of 55, the additional penalty could be waived.

Is There An Age Limit To Disbursing My 401K?

There is an age limit at which disbursement must begin.

The general rule of thumb is that you have to begin withdrawing from your 401K by the following April after you are 70 ½.

Why the ½?

It is just one of those bizarre rules that the IRS and the government has set up.

There are some allowances made for people that are still working even though they have passed their retirement age.

The best source of information about your particular situation can be found through your financial advisor and your human resource department.