Matching 401(k) employer contributions may be subject to vesting rules. These can affect when you own your balance & when you might lose some of it. How?

The contributions you make to your 401(k) savings are fully portable – if you leave your job, you can take them with you. But, the same may not be true of any matching contributions made by your employer while you work for them. You may be subject to vesting rules that can delay when this money becomes your money, even though it is invested in your name. What do you need to know about vesting?

What is Vesting?

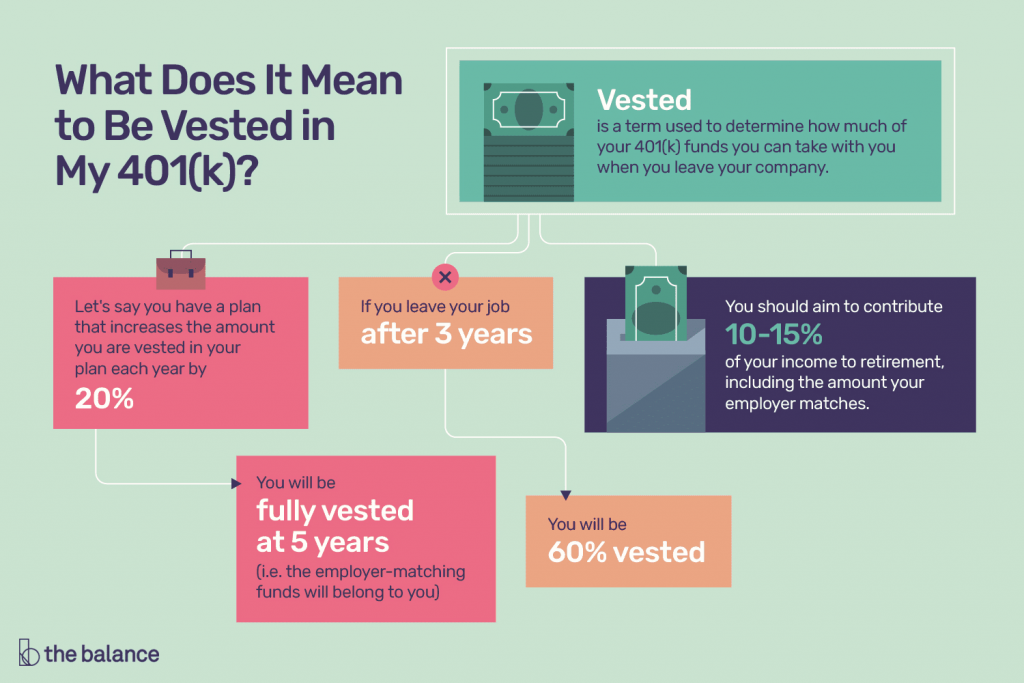

In 401(k) terms, this describes the point at which you are given rights to ‘own’ some or all of the balance of your retirement plan. If you are fully vested, then all the money basically belongs to you. Any contributions you make yourself vest automatically and they (together with any profits or losses) are yours whatever happens. Matched employer contributions, however, may be dealt with in a different way.

So, for example, an employer can specify how long you have to be employed before you are vested. It will still make contributions as set out in your contract but, if you quit your job before you hit the golden deadline, you may not be able to take some or all of the plan balance with you. The actual structure that is imposed can vary.

When Are You Vested?

As mentioned earlier, you have rights to your own contributions from the start but not necessarily to those made by employers. In some situations (e.g. SIMPLE and Safe Harbor 401(k)s) an employer is given no choice but to vest you immediately. Your rights to these contributions in other cases, however, will depend on plan terms. Companies have to stick to rules laid down by ERISA (the Employee Retirement Income Security Act) but they can choose different ways of managing the process. This can affect when you are given some or all rights to your plan balance.

Immediate, Cliff and Graded Vesting

Some employers skip the wait and give an immediate option with full rights – this may be dictated by plan type or by employer choice. Others may spread ownership gradually over time (graded vesting) or may make you wait a specific number of years before giving full ownership at once (cliff vesting). They can also make some changes to the scheduling of some of these options. These must, however, work to your benefit – an employer can shorten a timescale, but not extend it.

It is worth remembering that being fully vested in a plan does not mean that you can do what you like with the money and you will still need to stick to basic 401(k) rules. If you are considering quitting your job, are about to start a new one or to begin making contributions, do make sure to check up on how the actual vesting schedule will work.