Cash flow as the movement of cash or its equivalent in and out of a business. A business is extremely vulnerable to cash flow. It may have a fantastic product line, a large market to penetrate, extremely competent personnel, excellent customer service, and even great market exposure. It may even be profitable. But without positive cash flow, it will fail. Product and services may be the heart of a business, but cash is its blood. Without a sufficient amount of cash, there will be no resources to run the business.

What is Cash?

Cash is any asset a business can use in its current form, without creating additional debt, to pay for goods and services or any asset it can convert quickly to a form it can use for the payment of goods and services. Items that are always cash include money that the business physically has on its premises and available checking account balances.

There are things that look like cash, but actually are not. These include lines of credit such as credit cards, revolving credit from which you can write checks or obtain cash, checking overdraft lines, and potential equity investments. They may also include accounts receivable; that is money that others owe your company. If you are making sales that will be paid 30, 60, or 90 days in the future, they are not cash until they are actually paid. You may include them as anticipated cash only when they are due. If you looking ahead ninety days, an accounts receivable due on day ninety-one is not anticipated cash. Finally, remember that inventory is not cash.

What is a Cash Flow Projection?

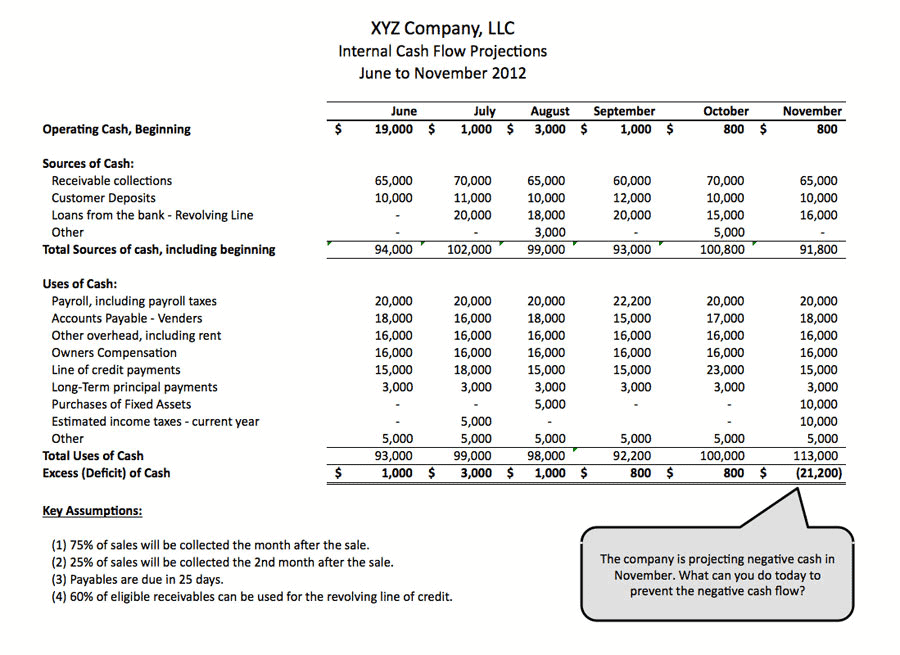

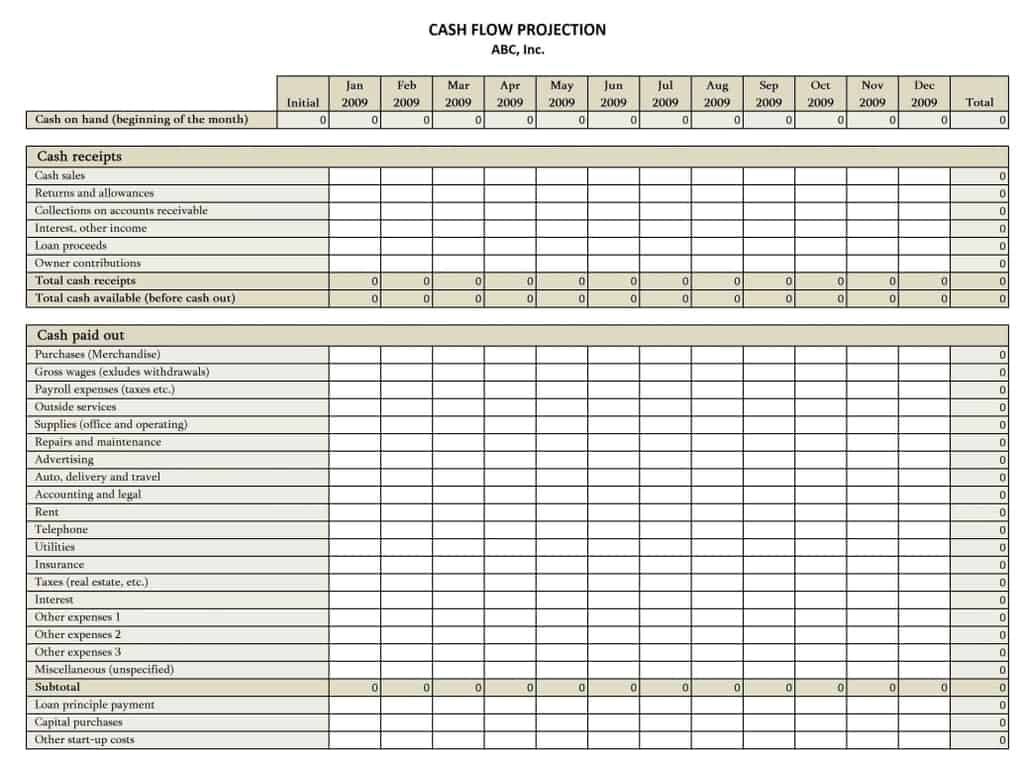

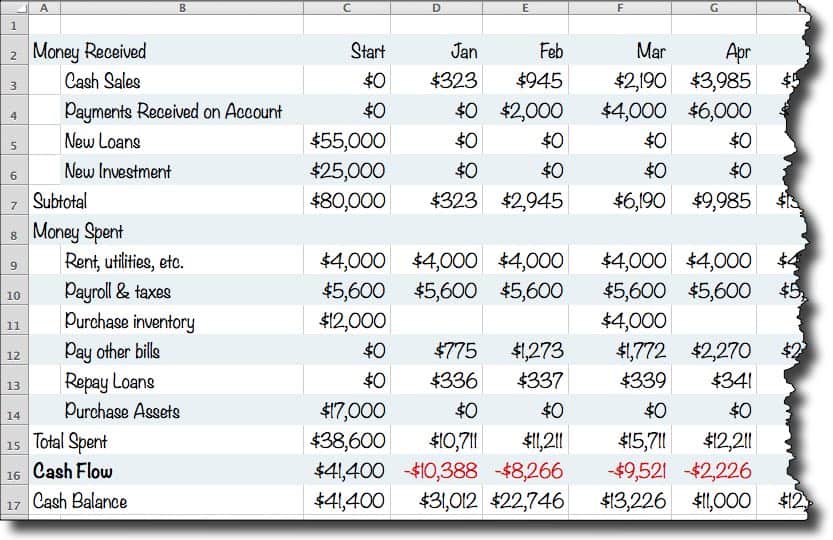

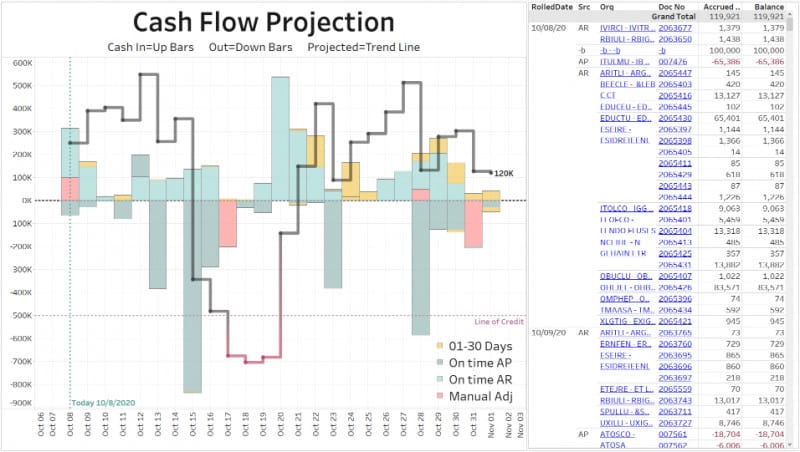

A cash flow projection is a prediction that anticipates the disbursement and receipt of cash. Cash flow projections typically cover a fixed amount of time, divided into periods. The cash sensitivity of your business determines how far into the future you choose to predict and how long and frequent a period you use. A typical business will make a twelve month projection with one month periods.

However, you may need projections with weekly or daily periods. Included in the anticipated cash disbursements are all expenses, debt repayments, interest, and taxes due within the period. If your business experiences unexpected disbursements of cash that you cannot identify ahead of time, include a minimal cash reserve sufficient to cover these items.

In your anticipated cash receipts, include actual cash that is on-hand or expected, such as cash from sales, accounts receivables due, tax refunds, interest receipts, and maturing financial assets. Do not include lines of credit, overdraft protection, or accounts receivables that are not due. Make sure that you have identified and minimized all of your expenses and other cash outputs and identified all sources of cash input before you begin the projection.

To prevent surprises, always have a cash flow projection that is current and realistic. Although some companies will wait until the current projection has almost expired before creating a new projection, it is better to have a perpetual projection. I prefer a thirteen-month projection. As soon as the current period is over, review the projection, make any necessary adjustments, and add a new period at the end. In this fashion, you always know your anticipated cash position for at least the next twelve months.

Cash flow projections always answer the following questions, among others, for each period:

- How much cash will you have on hand at the start of the period?

- What items are due during the period? Don’t forget to include items that not paid every period, such as quarterly taxes, employee bonuses, loan repayments, and the occasional pay-off of a revolving line of credit.

- Do you expect to incur unusual expenses that require payment outright? Perhaps you need a new piece of equipment for which, for whatever reason, financing it is not an option.

- How much cash do you expect to receive? From where? Include cash from sales based on historical reality. If your sales have increased at a fixed rate every period, the projection can show an increase providing that everything else remains more or less equal. If your sales have been flat or decreasing, the projection should reflect this. A cash flow projection is the wrong place for wishful thinking.

- When will you receive the cash?

- Are there non-liquid assets that will convert to liquid during the period?

A cash flow projection must do more than take your projected sales and projected expenses and lump them together. It must predict how much cash will be on hand at any given time.

Once you have determined how much money is due and how much cash you will have on hand or take in, you know your projected cash position. Your projected cash position is simply the difference between your projected cash output and your projected cash input (plus the starting cash). Subtract the output from the input. If there is an excess of cash, you have a positive cash position. If there is a shortage of cash, you have a negative cash position.

What if You Have Excess Cash?

If you have a positive cash position, determine what to do with the excess cash. The most common thing to do is to carry the cash over into the next period. But, if you have a revolving line of credit that is in use or owe money for your inventory or raw materials, consider using the excess cash to reduce these first. If you have a lot of excess cash, it is a good idea to put it to good use. You might use the cash to pay down some of your debt. Be careful, however, that you don’t create a negative cash position by paying down your debt. While paying down a revolving line of credit is a good idea because the credit remains available, paying a down a loan is different. It requires careful analysis.

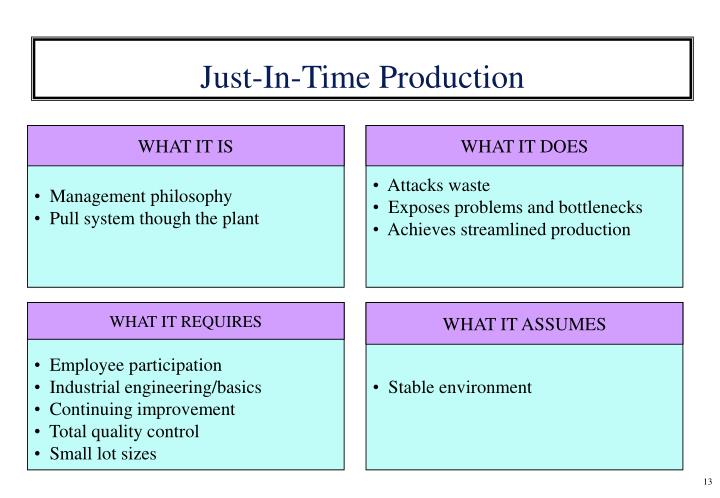

You may also use your excess cash to purchase additional inventory or raw materials. Remember, however, that inventory ties up cash. Use the cash to purchase additional inventory or raw materials only if it will give some benefit such as avoiding a price increase or taking advantage of lower prices because you are purchasing larger quantities. Many companies today use “Just in Time” or JIT systems for inventory and raw materials. That is, you purchase inventory or raw materials only when needed. If this is your standard operating procedure, there is probably a good reason for it. Use your excess cash for something else.

You can also use excess cash to make short-term investments. If you have cash you don’t need for thirty days, talk to your banker or financial advisor about putting it to use to earn more cash. Finally, remember that excess cash is not a gift. Don’t go looking for things to spend it on.

What if You Have a Cash Shortage?

If you have a negative cash position, you must find a way to make up for the shortfall. Look at all cash outputs prior to the period with the shortfall to see if there is a way to retain more cash to help cover the up-coming shortfall. Look for a way to reduce your expenses or increase your income or both.

An increase in expenses often accompanies an increase in income. Account for the additional expenses in your adjusted cash flow. You may be required to draw on your revolving lines of credit. Use these only to temporarily compensate when there is not enough cash during a specific period. Once used, they become part of your debt. Repay them immediately. Otherwise, they won’t be available for the next time you need them. A good idea if you use credit to cover a temporary cash shortfall is to immediately include its repayment in your cash flow projection.

A second alternative to cover a negative cash position is to increase investor equity. In other words, have your investors invest more money or increase the number of shares in your business. While this may be unavoidable when a business is young, avoid it if the business is mature. A mature business might require additional investment for capital expansion, but it should never require additional investment or additional long-term debt to cover operational expenses.

Finally, you might be able to borrow against your future positive cash flow. Maybe you can postpone a particular expense to a future period. Maybe your suppliers can extend payment terms or your long-term customers can pay anticipated purchases ahead of time. Ask people that owe you money to pay earlier. You may have to offer an incentive, but it is a reasonable approach.

Sometimes, you cannot avoid negative cash positions. However, there are a few things to keep in mind. First, negative cash positions should be predictable and accounted for in your cash flow projections. Second, they should be temporary and short-term. Third, you must always be prepared to handle them. If you are not prepared, your business will be in default and in very serious trouble.

A Cash Flow Projection is a Tool

Use the cash flow projection as a tool. Always have a projection that is reflective of your business cycles. Make sure that it is always up-to-date. When things happen that are not in the projections, analyze them carefully to determine the cause and to take corrective action.

The earlier you know about cash problems, the better you will be prepared to take care of them. Don’t forget, a business without cash is no business at all, regardless of how wonderful everything else might seem.