Quite simply, the most cost effective sort of life insurance coverage may be the sort that will finest meets your needs along with meets your financial budget.

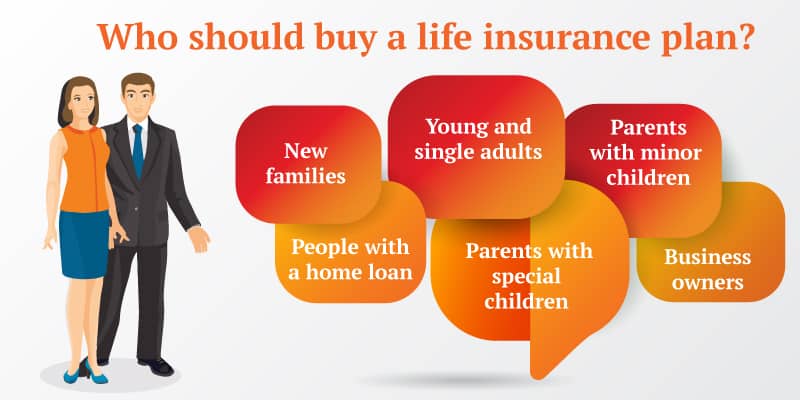

Very first, specify your purpose in investing in a life insurance policy. Could it be to deliver income alternative (or even, as several refer to it as, “lifestyle replacement”) for the dependents should you perish? Many people many people observe insurance coverage. They wish to ensure that when they perish, their partner and children will keep paying of the house loan (as well as hire), keep generating car installments and bank card payments, and also, obviously, maintain to be able to manage day-to-day necessities such as foodstuff and clothes. Furthermore, the advantage of a life insurance coverage might be your own family’s hope regarding ongoing to fund the children’s college degree.

You might have various other strategies to your policy. Probably, you’re assigning it as how you can spend, following your own loss of life, for your medical center or perhaps surgery bills, and for your own memorial along with burial as well as cremation. Healthcare expenses can readily cost thousands associated with dollars. And the cost of the memorial service as well as burial can certainly go beyond $10,500. You don’t would like this weight to be able to fall for a loved ones, and also at a time when they may be nearly all despondent as well as eager.

People seek out your life coverage to mention their own cathedral or even their forehead or even mosque, or simply a common charitable organisation, as the named beneficiary. The actual loss of life good thing about your health insurance coverage is definitely an considerate way to show simply how much an individual price as well as take care of a house involving praise and for any social or even advocacy organization.

The amount of the power is determined by your current prepared make use of. Obviously, you might want to be sure to give a substantial help to cover the family’s continuing requires. Calculate your present bills. And exactly how previous are the youngsters? How much money may your family must fulfill the spouse’s life-time needs and meet the requirements of one’s youngsters until these are don’t friends and family? Change for inflation (amount, conservatively, about 5% each year, just for the actual benefit of simplifying the actual computation).

If at all possible, the main benefit from your life insurance policy will over include the actual quantity. Will be the quantity $500,1000? 1 million? Far more? (Keep in mind: The common college degree right now fees around $20,500 to $35,500 a year, depending on if the university is public or even private. If the youngsters are young, realize that tuition-plus, naturally, space as well as board-will climb dramatically in between occasionally.) That’s the amount you will need. But exactly how considerably is it possible to manage?

You might be amazed at precisely how reasonably priced coverage can be, specifically term life (which can last for a specific “term,” for instance 30 years). But first, it is essential to perform comparison-shopping. Don’t get worried. It’s not agonizing as it was once, when you had to move from insurance provider for you to insurance firm, agent in order to agent, completing types at intervals of.

Currently, you can use a 100% free of charge and unbiased on the internet “quick-quote” support for example InsuranceLifeInsurance.com. You just answer a few simple inquiries and then just click 1 switch to acquire quotes all the best insurance agencies, simultaneously. It requires merely mere seconds. Amazing! So what have you been expecting? Exactly what is the most inexpensive sort of life insurance? The one that meets your requirements as well as suits your own budget and one which you discover via totally free, straightforward comparison-shopping!