Today’s mortgage market offers potential borrowers a bewildering array of mortgage products and optional extras. One such product is that of the offset mortgage, a product which allows the effective pooling of resources to save money in the long run.

What are Offset Mortgages?

Offset mortgages may be seen as not a singular product but a bundle of products, which allow an individual to save money on interest charges by the pooling of one’s assets and liabilities within a single financial institution.

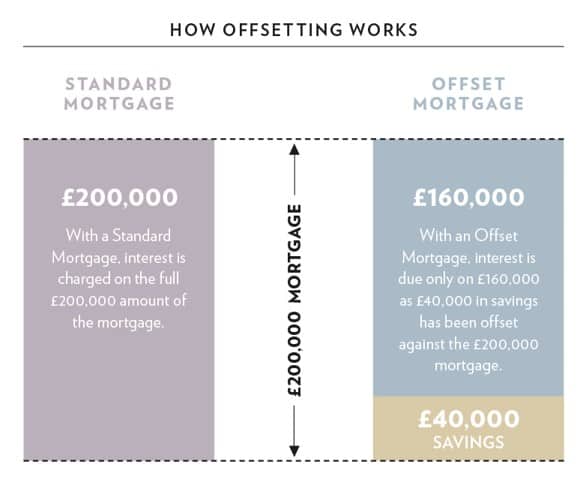

In essence, an offset mortgage in itself works like any other standard mortgage. However, the difference is that instead of paying an interest charge on the total outstanding balance of the mortgage, the offset mortgage allows an individual to offset any cash items held with the institution against the balance of the mortgage.

In simple terms, the borrower chooses to forego the interest paid on any savings and other forms of cash held, in return interest is paid on a smaller outstanding mortgage balance. On the basis that interest paid to savers is usually lower than that charged to borrowers, the individual usually stands to benefit financially from such an arrangement.

How does an Offset Mortgage Work: A Worked Example

The best way to consider how offset mortgages work may be so consider a worked example. In this case the following assumptions are made:

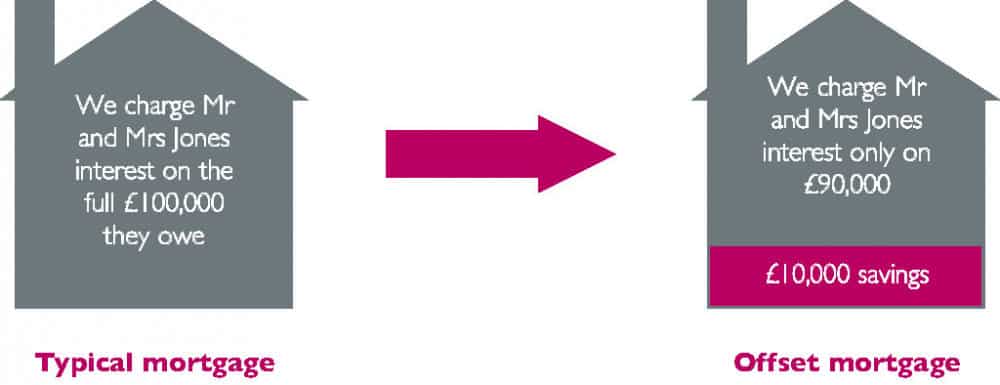

- £100k Outstanding Mortgage charged at 9%

- £10k Savings paying 3%

- £5k Current account paying 0%

Under a standard mortgage arrangement, the above scenario would see the individual paying an interest charge of 9% (£9,000) on the full outstanding balance of £100k and a payment of 3% (£300) on the £10,000 held in savings, nothing is received for the cash held in the current account. This gives a net cost to the borrower of £8,700 on the pooled resources.

However, if an offset mortgage is used then the saver forgoes the interest paid on any cash components of the resource pool, in return the cash component is subtracted from the outstanding balance of the mortgage.

In this example this means that in effect the borrower loses the 3% paid out on the savings component. However, the interest charge of 9% will now only be levied on the outstanding balance of the mortgage, which has been offset by the cash components.

As such, the borrower in this case would pay 9% on an offset mortgage of £75,000 resulting in a net cost of £6,750. This represents a substantial saving of £1,950 in interest charges when compared to the previous example.

In summary, the offset mortgage may initially appear to be a complex product. However, once the basic principals of the product have been understood, the offset mortgage may offer a simple way to save substantial amounts of money with little effort required.