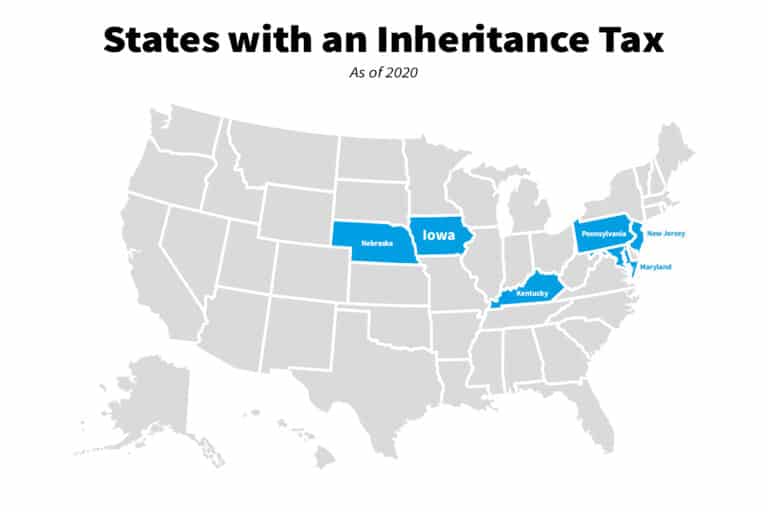

Iowa is one of several states that have an inheritance tax. This is a tax on the right to receive money or property owned by the decedent at the time of death. It is different from the federal estate tax, which applies on the total value of the estate. So if you inherit property from a relative or friend in Iowa, you could be subject to the Iowa state inheritance tax.

You may inherit money or property through the decedent’s will, or if there is no will, Iowa law provides for distribution of the property. Each beneficiary is subject to Iowa inheritance tax on his or her share of the decedent’s estate. But certain relatives of the decedent are exempt from the tax.

Exemptions

As pointed out by Roger McEowen and Neil Harl, professors at the Iowa State University, your relationship to the decedent determines whether you will be subject to the Iowa inheritance tax, and if so, at what rate. The more closely related you are to the decedent, the less tax you will have to pay, if any.

Property that passes to the surviving spouse is not subject to the Iowa inheritance tax. Since back on July 1, 1997, lineal ascendants (parents, grandparents, and great grandparents) and lineal descendents (children, adopted children, stepchildren, grandchildren, and great grandchildren) are no longer subject to the inheritance tax either.

For other relatives including a brother or sister, son-in-law or daughter-in-law, there is no exemption and the tax rate is from 5 to 10%, depending on the value of the share of the estate that is inherited. For non-related persons the tax rate is from 10 to 15%.

How is the net estate determined?

Since each beneficiary is taxed on his or her share of the net estate, it is first necessary to calculate the value of the net estate. This is done by making a list of all the decedent’s property that is subject to the Iowa inheritance tax, called the gross estate, and then subtracting certain debts and deductions.

Gross estate

According to the Iowa State Government website, the gross estate includes real estate and tangible personal property located in Iowa, in which the decedent had an interest. If the decedent was domiciled in Iowa at the time of death, the gross estate also includes all intangible property, including cash, bank accounts, promissory notes, accounts and notes receivable, stocks, bonds, and crop rent.

These intangible assets could be located in another state, but are included in the gross estate if the decedent was domiciled in Iowa.

Life insurance proceeds are not subject to the Iowa inheritance tax provided they are payable directly to the beneficiary and not to the decedent’s estate. If the proceeds are payable to the decedent’s estate, they would be subject to inheritance tax, provided the beneficiary who receives them is not exempt.

Property held in joint tenancy is included in the gross estate to the extent of the decedent’s portion of the property.

Roger McEowen and Neil Harl explain that the amount subject to Iowa inheritance tax depends on who provided the money or other consideration to acquire the joint tenancy property. If the decedent had provided all the funding, the entire amount would be subject to inheritance tax, even though it is held in joint tenancy.

The Iowa State Department of Revenue points out that some property may not be included in the estate for probate purposes but is nonetheless included in the estate for inheritance tax purposes. This could include annuities and certain retirement plans, trusts, retained life interests, and gifts made within three years of death.

Valuation of the property

Property is included in the gross estate at its fair market value on the date of the decedent’s death, or on an alternate valuation date six months after the date of death. It would be beneficial to use the alternate valuation date when property values are declining.

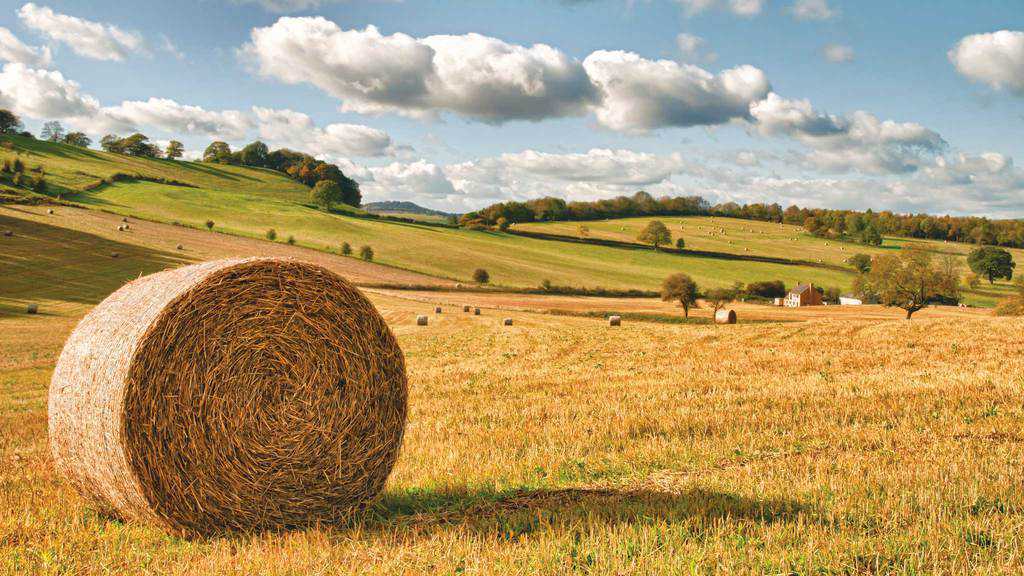

For farm land and certain qualified real estate in a family business, you can use a special use value, if you are eligible to use that value for federal estate tax purposes. As Professors McEowen and Harl explain, when real property is used for farming, there are two ways to determine its value under the special use valuation provision. One way is to capitalize the cash rent for comparable farm land in the locality.

To do this capitalization calculation, you divide the average annual gross cash rental, less property taxes, for comparable farm land in the locality by the average annual effective interest rate for all new Federal Land Bank loans. This calculation is based on the five most recent calendar years before the decedent’s death. The interest rate to use is the rate for the Federal Land Bank District where the land is located.

For example, if the average annual gross cash rental per acre is $200 and property taxes are $10 per acre, there would be $190 per acre to be capitalized. If the average annual Federal Land Bank loan rate is 5%, you would divide $190 by 0.05 to arrive at a value of $3,800 per acre.

When there are no cash rented tracts of comparable farm land in the locality, the other special use valuation method you can use is the average net share rentals from crop share leases. These net share rentals are the landowner’s portion of the crop share return from the land minus cash operating expenses paid by the lessor under the lease agreement.

Deductions

Once all property has been identified and the gross value of the estate is determined, certain liabilities and expenses are deducted. As indicated in the CCH Financial Planning Toolkit website, these deductions include the decedent’s debts including mortgages or liens that secure a debt on Iowa property owned by the decedent.

Deductions also include accrued state and local taxes, the federal estate tax, court costs, attorneys’ and the personal representative’s fees, costs for selling real or personal property of the estate, and costs for appraisals.

A reasonable amount can be deducted to cover funeral expenses and the allowance for the surviving spouse and minor children during the settlement of the estate that is granted by a probate court or judge.

In order to take a deduction on the inheritance tax return, the personal representative must certify that the expense or debt has been paid, or that the Director of Revenue and Finance is satisfied that it will be paid.

When the decedent was a resident of Iowa and the estate includes property located outside of Iowa, the liabilities related to the property must be prorated. Only the portion applicable to Iowa, if any, is deductible. When the decedent was not a resident of Iowa, deductions can be claimed only for debts and expenses related to property within Iowa.

Once the net estate is determined by subtracting the allowable deductions from the gross estate value, the inheritance tax is calculated on each beneficiary’s share.

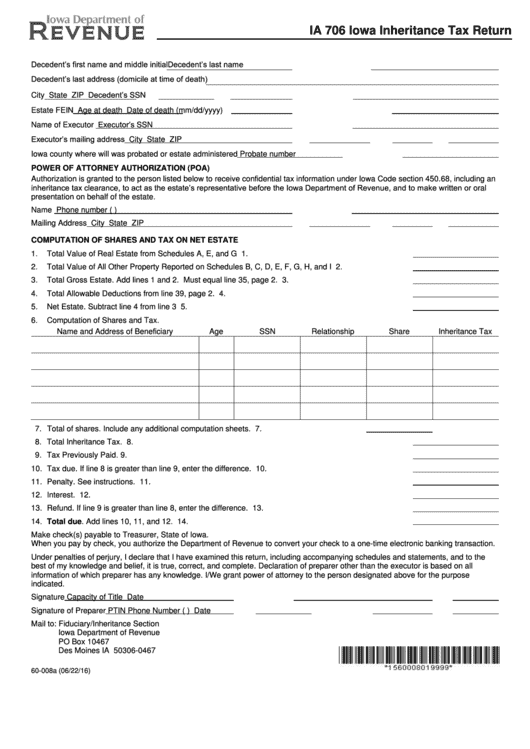

The name of each beneficiary and the relationship to the decedent must be listed on the inheritance tax return.

How to file

When the estate has been probated, the decedent’s personal representative, who may be the executor or administrator of the estate, is responsible for filing the inheritance tax return with the Iowa Department of Revenue. If the personal representative does not file the return, or the estate is not subject to probate, then the beneficiary must file the inheritance tax return.

The beneficiary is responsible for paying the tax, but the personal representative is responsible for seeing that the tax is collected and paid. Once the Iowa Department of Revenue has received payment in full, it will issue an inheritance tax clearance, which releases the property from the inheritance tax lien.

The Iowa Inheritance Tax is filed using form IA706, which can be downloaded from the Iowa State Department of Revenue website at www.iowa.gov/tax/forms/inherit.html. All the beneficiaries of the estate and their respective shares are included on one form IA706.

The inheritance tax return must be filed and any tax due must be paid by the last day of the ninth month after the date of the decedent’s death. You can request an extension but you have to pay interest on the unpaid balance of tax due.

Supporting documents such as copies of the will, contracts of sale, deeds, appraisals and other information should be filed with the inheritance tax return.

If a federal estate tax return is filed, a copy of that return should be filed with your Iowa state inheritance tax return. The Iowa State Department of Revenue may request additional documents as necessary.

Sources:

CCH Financial Planning Toolkit – Iowa Estate Taxes: www.finance.cch.com

Iowa Department of Revenue – Iowa Inheritance Tax Forms and Information: www.iowa.gov/tax

Iowa State Government – An Introduction to Iowa State Inheritance Tax: www.iowa.gov

Iowa State University – Iowa Inheritance Tax: www.extension.iastate.edu

Retirement Living – Taxes by State: www.retirementliving.com