Those looking to supplement retirement savings with annuity investments have a variety of products and potential returns to choose from. The security offered by fixed income annuities appeals to some. What is a fixed annuity and how does it work?

What is a Fixed Annuity?

These insurance based investments work in much the same way as other annuities. The individual invests cash in a product with a view to being paid an income in the future. Here, the payment made will be fixed/guaranteed so that the investor will know exactly how much they will be paid.

This security may suit those that want a clear idea of their return on investment and that prefer not to take risks.

How do Fixed Annuities Work?

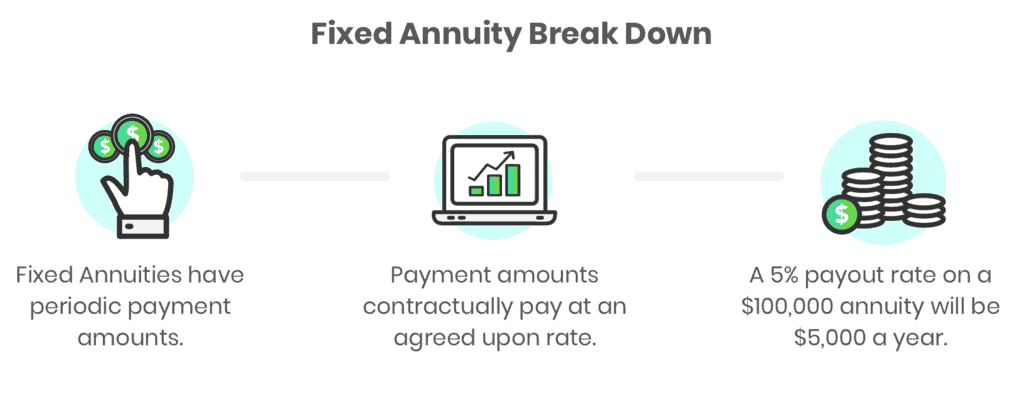

The aim of investing in a fixed annuity for most individuals is to create a regular income stream. Depending on the product chosen the initial investment could, for example, be turned into monthly, quarterly or annual payments. Lump sum payments/withdrawals may also be an option in some cases.

Payouts can be set up to last for life or may only last for a set number of years. Some individuals will buy a variety of annuities that they plan on accessing at different points during their retirement. Others will focus on a single investment vehicle. Keep in mind that fixed annuities can also be purchased/used at different times.

Deferred Annuities vs Immediate Annuities

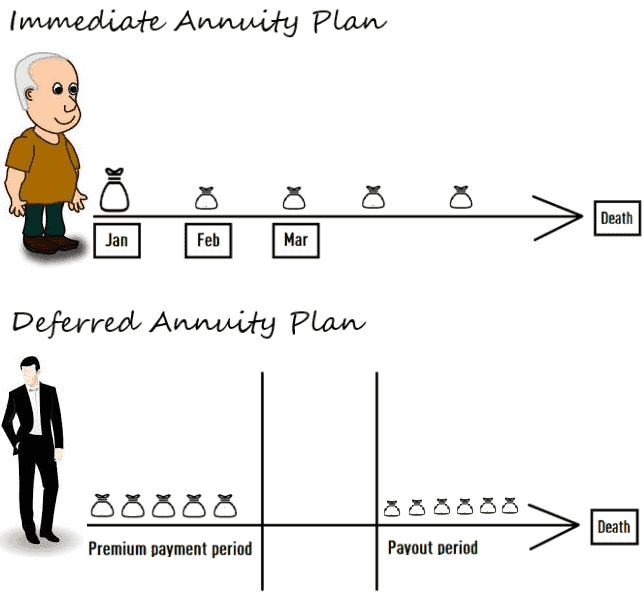

Those considering a fixed annuity purchase will usually do so on either a deferred or an immediate payment basis. In both cases, the cash paid will provide some form of income. The actual type of product chosen may, however, dictate when payments begin.

An immediate fixed annuity is usually paid for with a lump sum payment. The aim here is to create an income stream that begins virtually immediately. This may suit those close to retirement with some cash to spare who want or need to boost their income.

A deferred product is typically purchased at an earlier life-stage. This can be done with a lump sum payment or, in some cases, via regular/periodic investments. The agreed payments will then generally not be taken until the individual reaches retirement age.

Alternatives to Fixed Annuities

Some do prefer to buy a fixed annuity on the basis that this is a low risk investment. Others may, however, find that other products suit them better. Fixed rates may typically give guaranteed income and lower costs but this may come with some downsides.

Variable annuities, for example, may suit those that can take a greater risk. If investment conditions are good, then the income paid out may be higher. An equity indexed annuity may also be worth considering as these combine the security of a fixed annuity with the growth potential of a variable product.