Those considering using annuities as retirement planning solutions may need to choose between fixed and variable products. A fixed annuity may be seen as a safe bet as it delivers guaranteed income but some may prefer to take a higher risk option. What is a variable annuity and how does it work?

What is a Variable Annuity?

Annuities are insurance investments, most often used to save for retirement. These products are purchased either while the individual is still working or, in some cases, close to/after retirement. The aim here is to provide an income stream for later life.

A variable annuity pays out like any other product of its type but the payments made are not set at a fixed rate. They may increase or decrease according to investment performance and market conditions.

If things go well, then this could provide a higher income than fixed rate alternatives although there is the risk of lower payouts if the product does not perform well.

How do Variable Annuities Work?

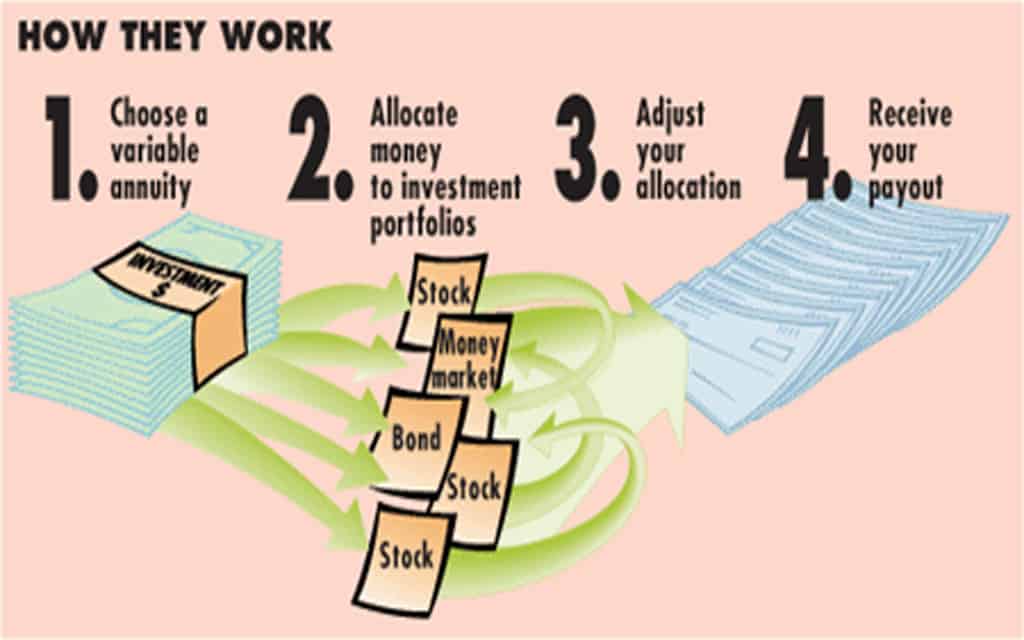

A variable annuity can be set up to last for life or for a specified number of years. Some products are purchased with a lump sum; others may be based on regular or even periodic payments. When an individual buys into a deal, they can decide how payouts will ultimately be made.

In some cases the individual will be looking for a regular income and may, for example, opt for a specific payment (i.e. monthly, quarterly or annual) schedule. In some cases it may be possible to take out lump sums. The type of deal on offer may vary according to the time of life when the annuity is purchased.

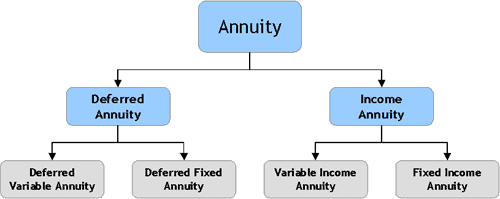

Understanding the Difference Between Deferred and Immediate Variable Annuities

It is possible to buy variable annuities years before the income stream will be needed. These deferred products may give a higher return for a lower cost as they will have time to build income. In some cases, however, individuals will buy an immediate variable annuity.

This often happens close to/in retirement if there is a need to boost income and an available lump sum to make a purchase. In both cases it is, again, worth remembering that there are no guarantees of payment levels here no matter how early or late the individual buys an annuity.

- What Is Aromatherapy Vs. What Are Essential Oils?

- What is La Tomatina in Bunol, Spain Like? What to Expect at the Famous Tomato Throwing Festival

Alternatives to Variable Annuities

Although a variable annuity may suit some investors, others may find that they get better deals with alternative products.

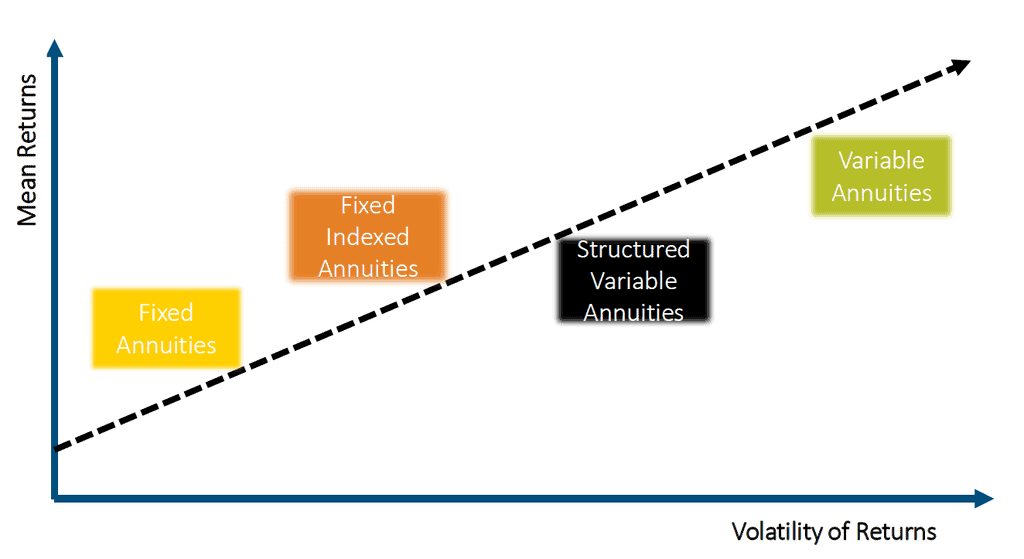

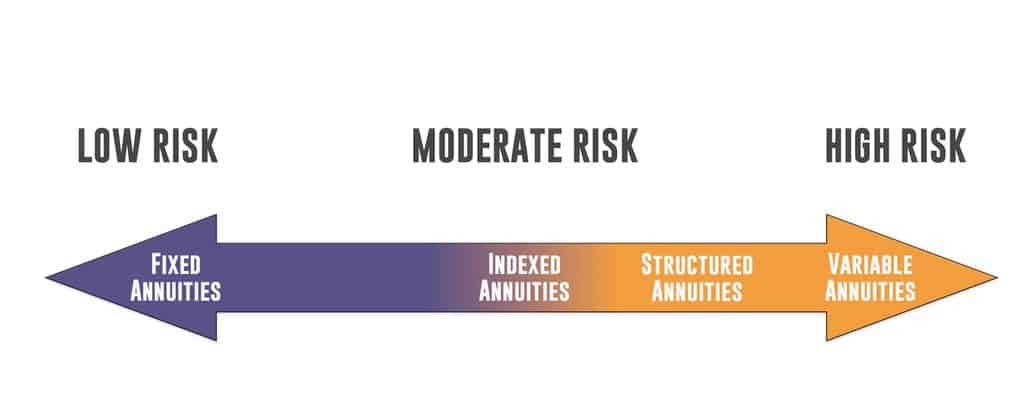

Variable options may give the chance of higher income that could better compensate for cost of living increases over time, but they could also deliver less than fixed annuities and pose a higher investment risk. The charges levied may also eat into potential returns.

Those looking for a safer guaranteed income may want to investigate fixed annuities. It is also possible to combine both fixed and variable elements in an equity indexed annuity so this may also be worth checking out.