The nonprofit world is full of references to a “501(c)(3).” Sometimes the term refers to an organization’s status and sometimes it refers to the organization itself. What is a 501(c)(3), and why do so many nonprofits take it seriously?

501(c)(3) Defined

The term “501(c)(3)” refers to the section of the U.S. Tax Code that grants tax exemption to a wide range of charities.

Section 501(c) in general has over thirty sections, all of which grant tax exemption to a specific kind of organization. The vast majority of private charities in the U.S. fall under section 501(c)(3).

To be eligible for tax-exempt status under section 501(c)(3) (or, in other words, “to be a 501(c)(3)”), an organization’s purpose and activities must fall under at least one of eight different categories.

The organization must pursue activities that are one (or more) of the following:

- religious;

- charitable;

- scientific;

- focused on public safety;

- literary;

- educational;

- focused on national or international amateur sports; or

- focused on preventing cruelty to children or animals.

An organization must fall into at least one of the above categories to qualify as a 501(c)(3). However, an organization’s activities may cover as many categories as it likes. For instance, a science center may offer classes that are both scientific and educational, or a place of worship may run an orphanage in pursuit of a religious doctrine teaching kindness to children.

In addition to meeting the categorical requirement, a nonprofit seeking tax-exempt status under section 501(c)(3) must also organize its business in an IRS-approved way. The IRS required that all 501(c)(3) institutions be organized as either:

- a corporation;

- an association; or

- a trust.

Nonprofits are generally incorporated or otherwise organized under the law of the state they’re in, rather than federal law.

A copy of the organization’s articles of incorporation, operating agreement, or other organizing documents must be filed with the IRS when the nonprofit applies for 501(c)(3) status. An individual or sole proprietorship cannot receive tax-exempt status under 501(c)(3).

Restrictions on 501(c)(3)s

In return for receiving 501(c)(3) status, an organization must adhere to certain restrictions required by the Tax Code.

Perhaps the most important is the prohibition on private profit or benefit. In short, the nonprofit’s revenues may not go to benefit any private shareholder or individual. For instance, 501(c)(3) nonprofits are not allowed to distribute dividends to shareholders. They may, however, pay reasonable wages and provide other benefits, such as health and retirement plans, to their employees.

Another important restriction on 501(c)(3)s is political: a 501(c)(3) may not engage in campaigning for a particular individual or in most types of political lobbying.

Although a 501(c)(3) may affiliate itself with a 501(c)(4) for lobbying purposes, the IRS rules that limit 501(c)(3) lobbying are so specific and complex that most 501(c)(3)s steer clear of political activity entirely. Engaging in prohibited political activity, even by mistake, can result in hefty fines or even loss of 501(c)(3) tax-exempt status.

Even though they may not lobby, 501(c)(3)s may engage in other politics-related activities. For instance, a 501(c)(3) may petition its legislators on issues of public policy.

It may also produce political information such as candidate guides and hold candidate forums, as long as information is presented in an impartial manner and all candidates are given an equal opportunity to participate. And employees of 501(c)(3)s may donate their own time and money to any campaign or candidate they choose.

Responsibilities of 501(c)(3)s

In order to keep its 501(c)(3) tax-exempt status, an organization must meet certain IRS filing requirements.

Chief among these is the Form 990, which tax-exempt organizations must file every year. The Form 990 comes in several different formats; which one an organization should use depends upon the amount of its gross receipts that year.

If a 501(c)(3) receives income not related to its charitable purpose, that income may be taxes as “unrelated business income.” For instance, if a museum sells a building, the income from the sale may be taxed because it is unrelated to the museum’s charitable purpose of educating the public.

Income from admission fees to the museum, by contrast, would not be taxed because the admission fees are directly related to the educational material the museum offers the public.

Also, a 501(c)(3) must still pay payroll taxes on the wages of its employees. It may also have to pay state and local taxes, such as property tax, if it does not meet the state’s or locality’s criteria for tax exemption.

- What Is Aromatherapy Vs. What Are Essential Oils?

- What is La Tomatina in Bunol, Spain Like? What to Expect at the Famous Tomato Throwing Festival

Why Apply for a 501(c)(3)?

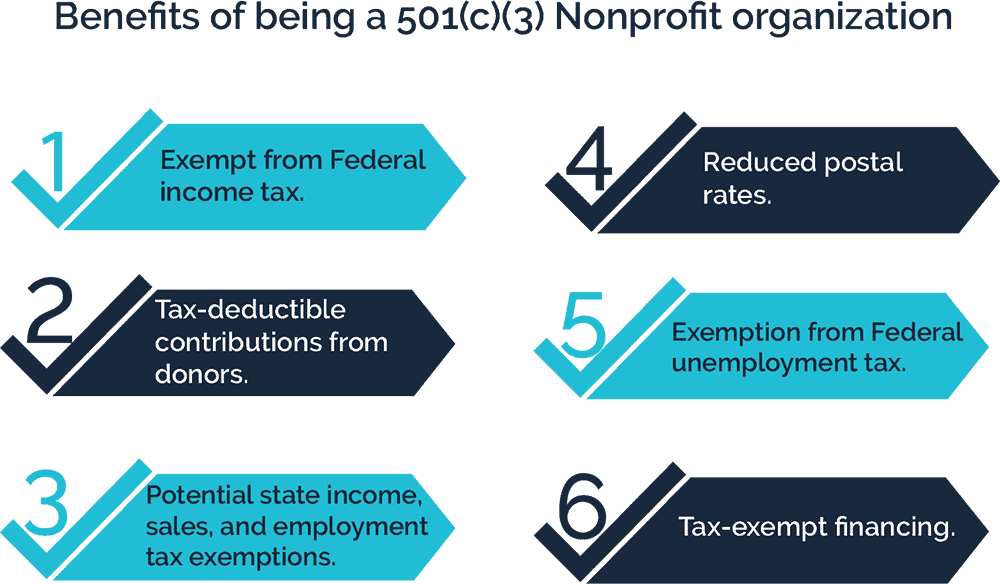

The first reason many nonprofit charities seek a 501(c)(3) designation is that it grants exemption from a number of federal taxes. Exemption from these taxes frees up money and other resources for an organization to use to expand its charitable services. Also, a 501(c)(3) may help a charity gain exemption from state taxes. Whether a state requires or will even consider 501(c)(3) status for state tax exemption varies by state.

Second, a 501(c)(3) opens up the door for donations. Section 170 of the U.S. Tax Code allows donors to 501(c)(3) organizations to deduct their charitable contributions from their own taxes. The IRS requires documentation such as receipts for donations above a certain amount; as of now, the amount was $250 USD.

Deduction of charitable contributions is so important to donors that many will not donate goods or money if the organization does not have a 501(c)(3). Also, the 501(c)(3) exempt the nonprofit itself from paying taxes on donations received.