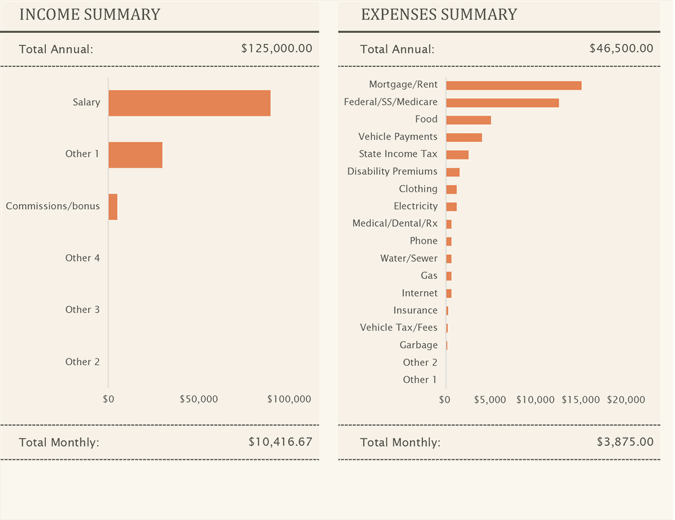

A budget is a monthly list of all the money you take in and all the money you pay out, and where it goes. The money you earn or take in is your income, which includes all wages, pensions, benefits, child support, alimony and investment income. This money is used to pay for your fixed and variable expenses, such as the roof over your head and the food you eat.

Preparing a budget shows you how to gain better control of your money and manage it successfully, allowing you to move closer to your goal of becoming debt free. Once you become aware of how much you take in and pay out each month, you’re more likely to see where you can reduce the amount you pay out.

Follow These Steps to Create Your Personal Budget

Step 1: Get Organized

Organize your bills, receipts and statements to create a monthly cash flow worksheet.

Complete the worksheet for three consecutive months, figure the average per month for each of the categories, and you’ll paint a reasonably accurate picture of what you do with your money.

Examples of Typical Expenses

Fixed Expenses (same each month)

- Federal, state, Social Security tax

- Mortgage payment/rent

- Homeowner’s or rental insurance

- Vehicle payment

- Vehicle insurance

- Medical insurance

- Life insurance

- Education

- Telephone (landline and/or cell)

- Cable/satellite TV

- Internet

- Public transportation

- Pet care

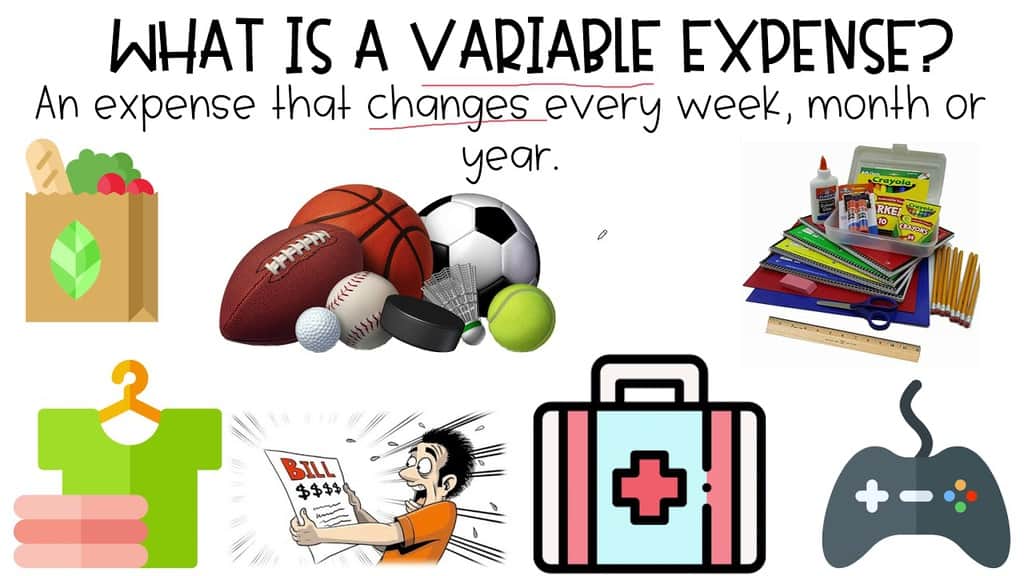

Variable Expenses (vary each month):

- Child care (nursery, babysitting)

- Groceries

- Eating out

- Entertainment, hobbies, recreation

- Utilities (electricity or natural gas, water)

- Home, yard maintenance

- Clothing, accessories

- Gifts, holidays

- Gasoline, parking fees

- Vehicle maintenance

- Vacations

- Retirement savings

- Fees (bank, credit card)Personal care (haircuts, cosmetics, dry cleaning)

- Charities

- Savings (retirement, emergency)

- Other (alcohol, tobacco, magazines)

Step 2: Monitor Your Expenses

Whether you end each month with a gain or a loss, you can always find ways to cut some expenses. To accomplish this, use at least one month to monitor and record what you spend. Carry a small notebook and write down all your spending—every cup of coffee, tank of gas, ATM fee, haircut and candy bar—every day. You will begin to understand your spending habits and answer the question, “Where does all my money go?”

- What Is Aromatherapy Vs. What Are Essential Oils?

- What is La Tomatina in Bunol, Spain Like? What to Expect at the Famous Tomato Throwing Festival

Step 3: Reduce Your Expenses

Once you’ve looked at the past, it’s time to learn your lessons and move into the future. Examine your cash flow worksheet and determine which items must remain, which items you can reduce, and which items you can eliminate. An important question to ask yourself as you go through your list is: “Do I need this item, or do I merely want it?”

Of the items you need, which ones can you reduce? For example, if you spend $130 per week on groceries, can you reduce that number to $110 without unreasonable sacrifices?

The most important thing to remember about your budget is that it’s about more than just listing your income and expenses. It’s about finding ways to save money and then doing something about it.