Many employers and government entities encourage people to receive payroll and benefits payments through electronic funds transfers known as direct deposits. EFTs enable payers to transmit funds into the recipient’s checking account.

To initiate an automatic checking deposit, a payee must provide the payer with an account number, routing number, and the name and address of the receiving bank.

History of Electronic Funds Transfers

EFTs became widespread after the invention of automated-teller machines during the 1960s. In 1978, Congress passed the Electronic Funds Transfer Act, which covers transactions involving ATMs, debit cards, direct deposits and other similar instruments. In 1985, a Supreme Court ruling that ATMs could not be classified as bank branches, paved the way for EFTs to cross state lines.

The National Automated Clearing House Association reported that more than 4.5 billion direct deposit transactions occurred in the U.S. in 2009.

Direct Deposit Functions

Many U.S. employers use direct deposit services offered by third-party vendors to pay their employees. The federal government offers direct deposits to Social Security recipients, veterans and government workers.

The Internal Revenue Service encourages people receiving income tax refunds to sign up for automatic deposits. Many state governments require people receiving unemployment to set up direct deposits. Those who have no existing checking accounts receive their direct deposits through prepaid debit cards.

Direct Deposit Benefits

The U.S. Treasury estimates that, if everyone receiving government payments utilized direct deposit services, it would save the Treasury $130 million per year.

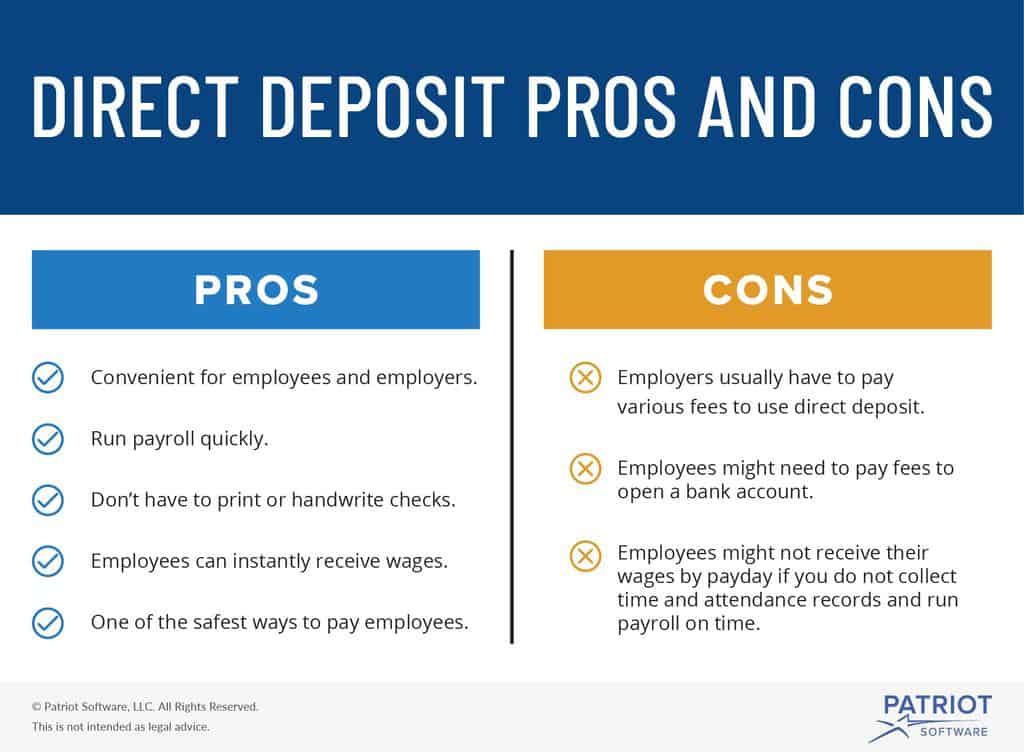

Direct deposits eliminate the need to pay for postage. To reduce expenses, many states no longer mail checks for payroll or unemployment. Employees who receive payroll checks on Friday would normally have to wait until Tuesday morning to gain access to funds. Direct deposit recipients have access to funds on payday.

Payment Processing Time Frame

When people sign up for direct deposits from Social Security, it takes between 30 and 60 days for the service to become active. Many employers require two pay cycles to implement direct deposits for employees.

Most employers run test deposits of zero dollars to new accounts to ensure information is accurate before beginning regular EFTs. Most payroll and government checks enjoy next day availability when deposited at banks but direct deposits are immediately available.

- What Is Aromatherapy Vs. What Are Essential Oils?

- What is La Tomatina in Bunol, Spain Like? What to Expect at the Famous Tomato Throwing Festival

Negatives Of Direct Deposit Payments

All owners listed on joint checking accounts have equal access to funds regardless of the origin of a direct deposit.

There are no laws that prevent someone draining an account after a direct deposit populates it with funds intended for another account owner. Direct deposits often take a few months to change and people who have to freeze accounts due to fraudulent activity usually experience long delays when trying to access funds that were not re-directed in a timely manner.