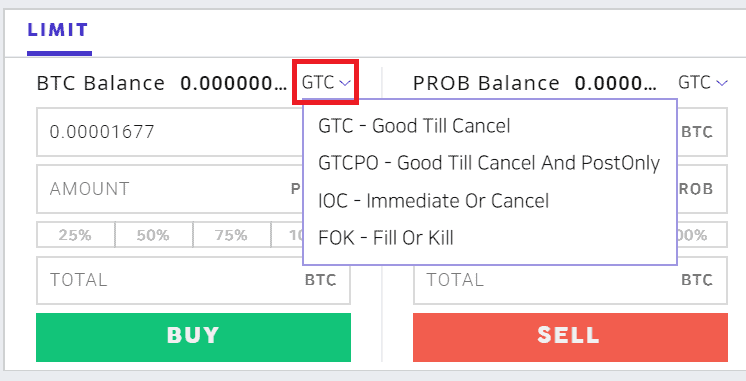

Of the many types of stock trading orders, the Fill Or Kill trade is the one that must be immediately carried through in its entirety (filled) or it is canceled (killed).

This is useful when someone wants to take on or unload all specified shares of stock immediately (at a certain price, if it is a limit order), or it is canceled, as it is not even attempted if it cannot fully trade on behalf of the investor.

What is a Fill Or Kill Order in Stock Trading?

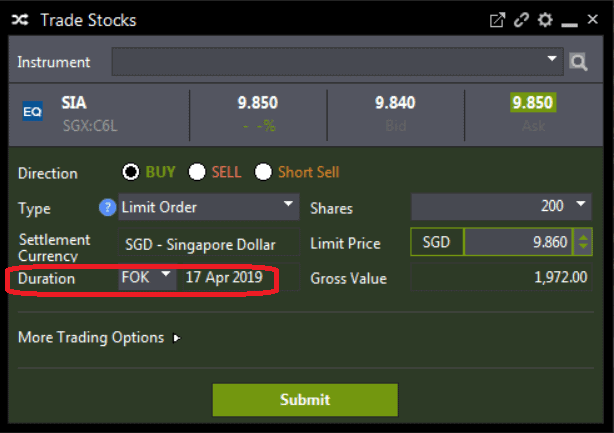

The FOK trade is one that buys or sells immediately and completely. If an investor wants to take on a certain amount of shares (at a certain price for a limit FOK), this order will complete if it can immediately fill in its entirety, or it is canceled and abandoned. Investors with accounts at online trade sites like E-Trade and Scottrade may utilize this exchange.

Example Market FOK Trade in Investing

A market order to buy or sell using the FOK component is generally one placed for a large number of shares. For instance, an Fill Or Kill buy market order to purchase 10,000 shares of a security will fill if sellers are available and all shares can be taken on at once. In a sell market order, the Fill Or Kill means that there must be buyers enough to purchase all shares immediately, or the order is canceled.

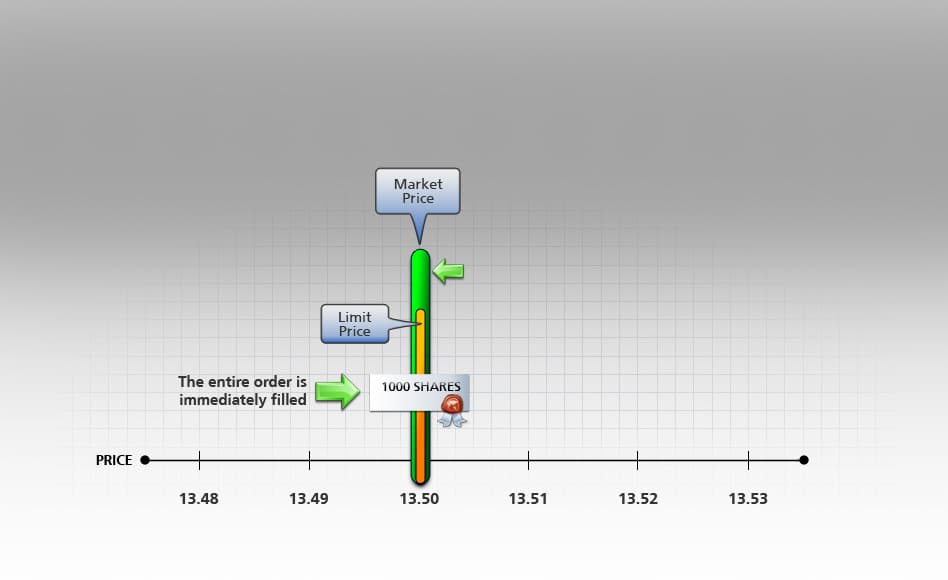

Example Limit Fill Or Kill Order

Suppose that a stock has been trading at around $5 for the past few hours. An investor looking to purchase 1,000 shares could set a buy limit order with the FOK component, and as soon as the order is enacted, either 1,000 share will be bought at $5 or less, or none will be bought at all. If enough sellers are available, and the value is within the $5 limit at the time of the order, it will fill completely.

A sell order works the same way. Suppose that an investor is looking to unload 1,000 shares of a stock with a limit price of $10. As soon as the order is placed, it will fill by either unloading all 1,000 shares at $10 or better at once, or it will cancel.

The Fill Or Kill order in stock trading is an exchange that will never trade partially.

It can be very useful when someone wants to buy or sell immediately, but the standard market order is too dangerous (because of possible price fluctuation), as a limit FOK trade will only act if it can immediately fill at the set price or better, which means that it will cancel if it cannot buy or sell all shares at a price that is satisfactory to the investor who set the order.