Living trusts are often used as part of the overall estate planning process. These trusts can come with various benefits, depending on the kind of trust that is used. What is a living trust and why do people use these solutions?

What are Living Trusts?

A living trust gets its name from the fact that is created while the individual is alive rather than after their death. In estate planning terms these trusts are most often used to manage assets.

This involves putting legal title into the control of a trustee. In some cases this will be the individual setting up the trust; in others it will be a third party.

What Does a Living Trust do?

Living trusts come in different forms and can be used for different reasons. Trusts are most often used to:

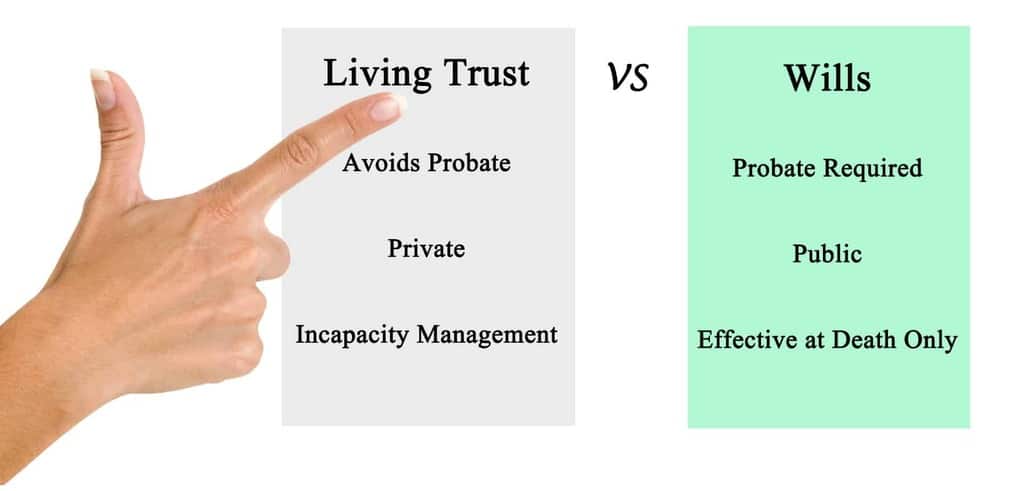

- Help avoid the probate process.

- Reduce commitments to estate taxation.

Not all trusts will necessarily do the same things or suit all circumstances and it is important to choose the right option to suit individual needs to maximize potential benefits.

What is the Difference Between a Revocable and an Irrevocable Living Trust?

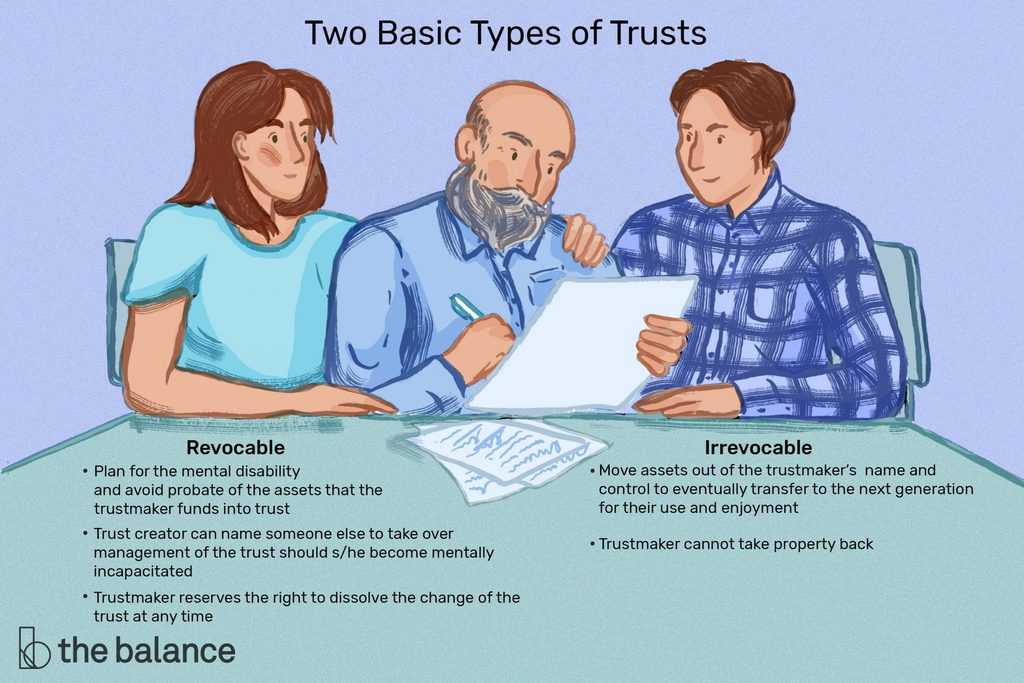

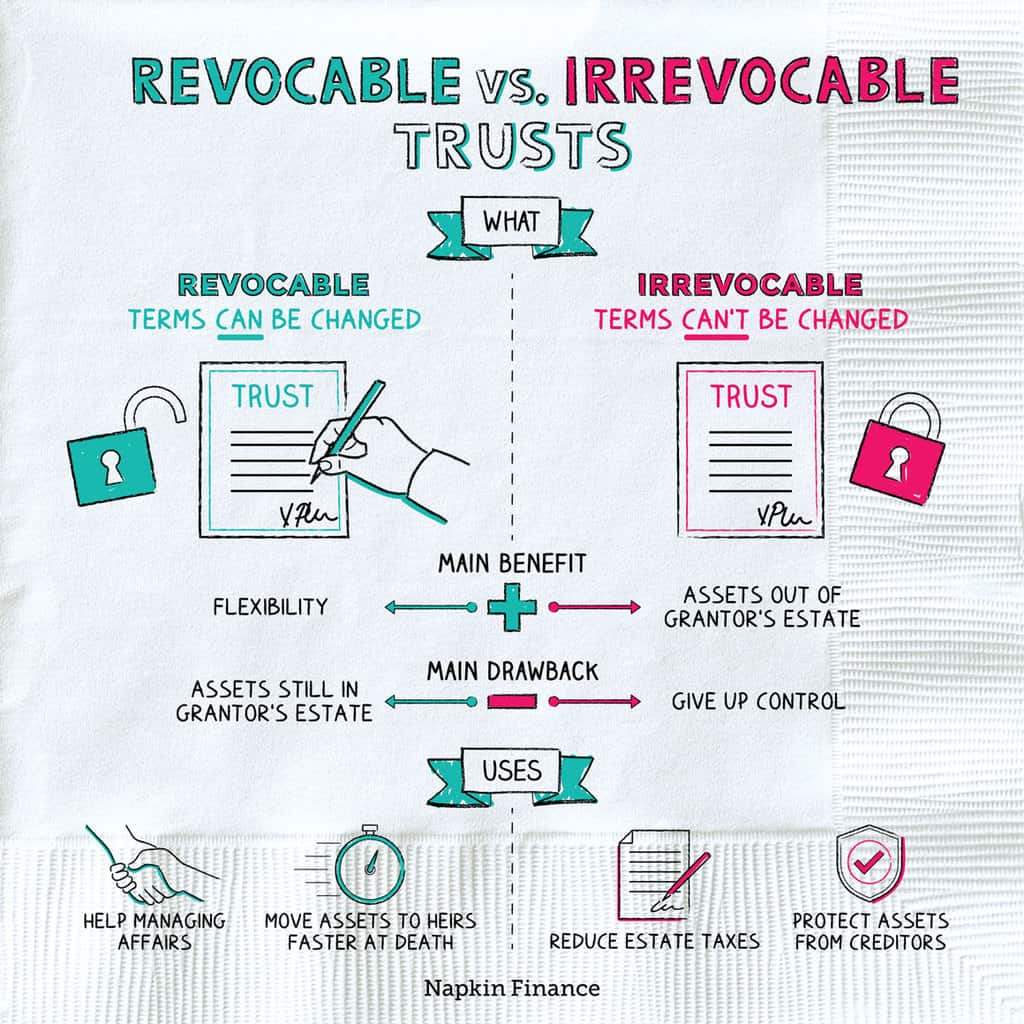

There are two main basic types of living trusts. The type that is chosen may well have a bearing on the benefits that it brings.

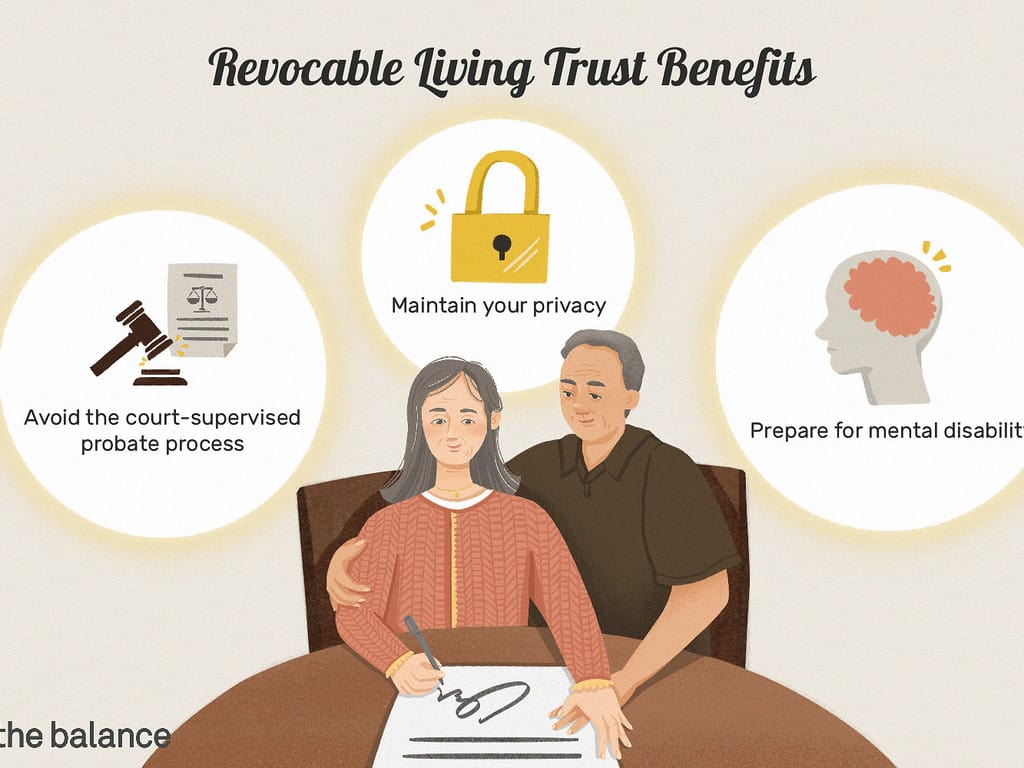

- Revocable Living Trusts – these trusts are most often set up by the individual naming himself/herself as the trustee to retain control of assets and what happens to them. They are known as revocable as they can be amended and ended at any time.

This kind of trust is most often used to simply bypass the probate process and will not give estate taxation benefits as the property remains part of the individual’s assets.

- Irrevocable Living Trusts – these trusts do not generally allow the individual to change or revoke them once they are established. They basically take property out of their control.

Although this can be a big step to take it may give savings on estate taxes and this solution may suit some circumstances. One of the more commonly used irrevocable living trusts is the AB or marital bypass trust.

- What Is Aromatherapy Vs. What Are Essential Oils?

- What is La Tomatina in Bunol, Spain Like? What to Expect at the Famous Tomato Throwing Festival

In its simplest form a living trust may save time and money in the standard probate process. More advanced types of trust may also save on estate taxes when the individual dies.

In both cases, however, it is worth remembering that setting up living trusts as part of the estate planning process may cost money and the overall benefits should be closely scrutinized before choosing this as a solution.

Although some Internet sites and books claim to allow individuals to set up their own basic living trusts this is not something to enter into lightly without consulting an attorney.

These are legal documents and individuals may want to take advice from a qualified and experienced estate planning specialist to make sure that they make the right decisions for their circumstances and get the right benefits put into place.