If you understand what a PIP is, you can unlock the door to success and profits in the Forex market.

The foundation of Forex is the buying and selling of currency. Money and profit is made by leveraging the exchange rate of each currency in comparison to each other. The way that the Forex measures this change in exchange is called a PIP.

Technical Definition

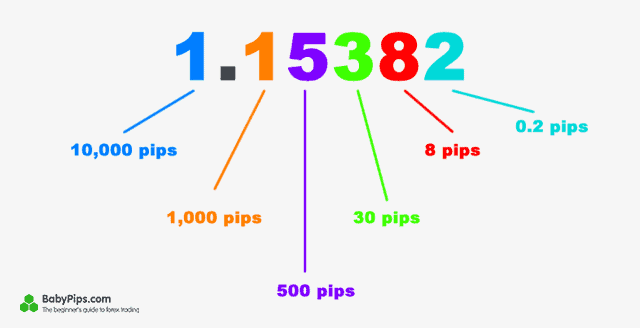

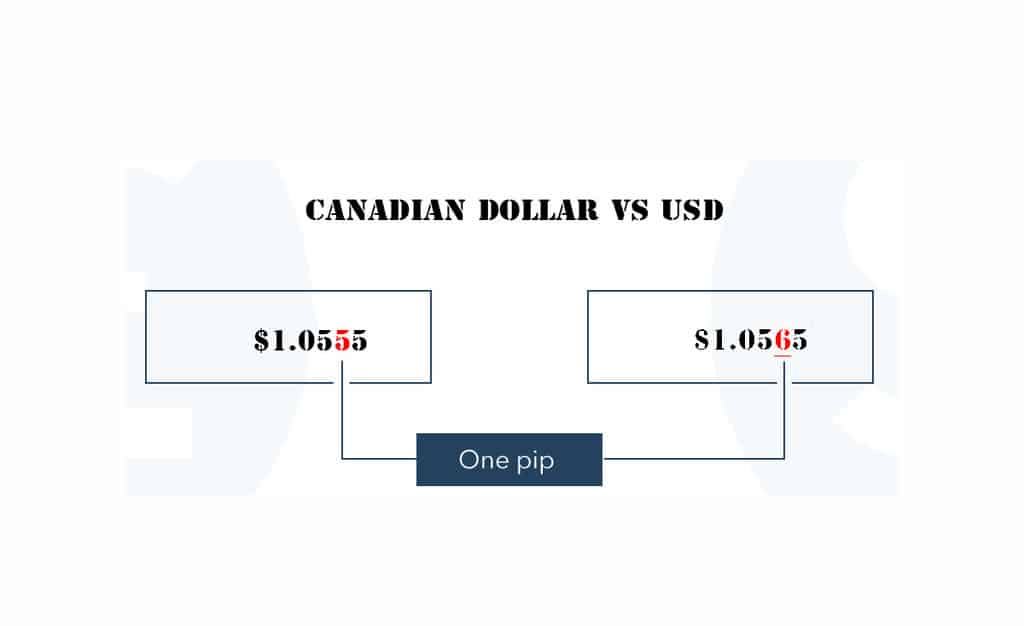

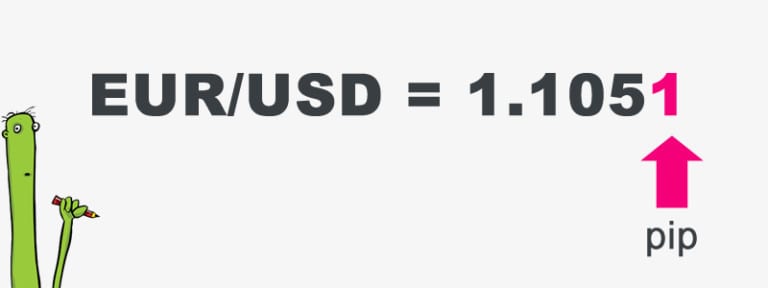

The technical definition of a pip is a Percentage in Point. All currency is quoted to four decimal places, with the exception of the yen. For example the current exchange rate of the Canadian Dollar to US dollar is 1.0555. Each rise and fall of the fourth decimal place is a pip.

A pip then, is equal to 1/100th of a cent. If in the example given the value of the Canadian Dollar was 1.0565 it would have risen ten pips.

How PIPS are used

Pips are used to calculate profit and spread. When a Forex broker states their pip spread they are stating how much the currency needs to change before their commission is covered and you start to take a profit. A lot of brokers use a two to five point pip spread, depending on the currency.

To calculate a profit from pips involves simple math. Take for example the currency pair of USD/GBP. If the price quoted was 1.0500 and you wanted to buy $10,000 USD worth of pounds you would pay $10,500 USD.

If during market trading the exchange rate rose to 1.0600 and you sold your currency, you would have $10,600, resulting in a $100 profit. It’s not uncommon for movements in the double and triple digits with some currencies during regular trading.

Here are some more examples:

USD/CAD at 1.0555

Pip Value equals 1 decimal point divided by the exchange rate

.0001 / 1.0555 = 0.0000947

USD/NZD at 1.3520

Pip Value equals 1 decimal point divided by the exchange rate

.0001 / 1.3520 = 0.0000739

Do you like it? What is That Hedging on The Forex Market

Leverage

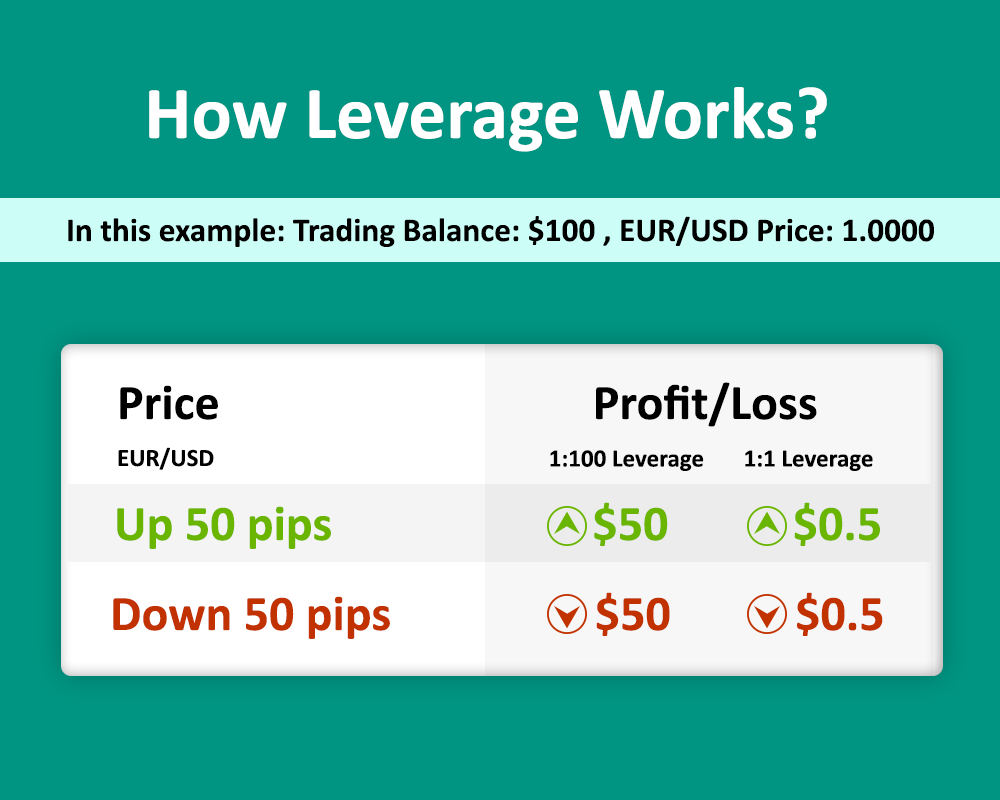

Unless you are Warren Buffet, you will be using some form of leverage when trading Forex. Leverage is using a small pool of money to control a large pool of money, so for a broker who offers 20 to 1 leverage you can control $20,000 worth of cash for only $1,000.

So to calculate profit, you multiply your pip value by your leverage. Here is an example:

USD/CAD at an exchange rate of 1.0555 (.0001 / 1.0555) x 100,000 = $9.47 per pip

USD/NZD at an exchange rate of 1.4555 (.0001 / 1.3520) x 100,000 = $7.39 per pip

Using this example, if you buy USD/CAD and it rises 10 pips above the spread, you make a profit of $94.70. The downside to leverage in the Forex is if it drops by 10 pips, you very quickly can wipe out your profits or even generate a margin call, and lose everything in your Forex account.

So what is a pip? If you understand it, it’s the key to profits and success in Forex.