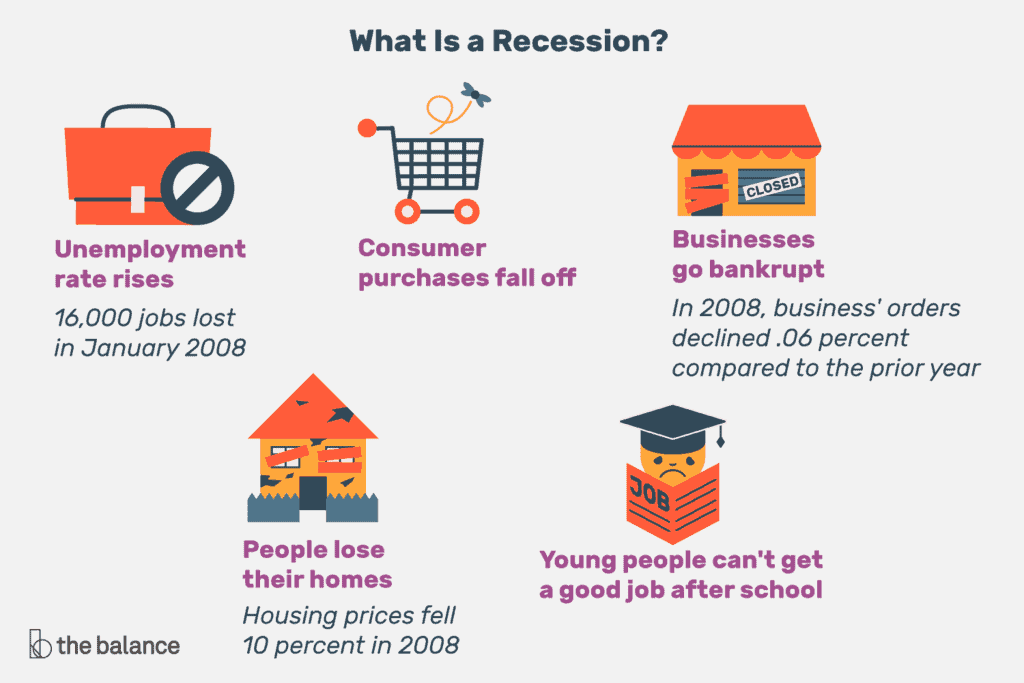

To understand what a stimulus bill is intended to do, one must first understand what causes an economic slowdown or recession–namely less spending. If people and companies spend less, they buy less, meaning companies produce less, meaning they need fewer workers, meaning they pay less or let workers go, meaning people have less money to spend and it starts all over again.

In short, an economic stimulus bill is federal legislation that designed to inject money into the economy quickly so people spend it (rather than save it or pay off old debts neither of which generate new economic activity) thereby breaking the chain of less spending and restarting economic growth. There are a number of ways policymakers can try to do this.

Economic Stimulus Proposals

Generally, there are two ways for the federal government to put more cash into the economy — spend more or tax less. Each of these methods has positives and negatives and within each category there are a number of specific proposals that have demonstrated various levels of success.

Spending proposals include direct payments to individuals such as the rebate checks most Americans received earlier this year. Other options include extending unemployment benefits, increasing food stamps payments and funding infrastructure projects like roads, schools and bridges.

Tax proposals include reducing or eliminating the payroll tax, temporarily lowering tax brackets, reducing capital gains tax, lowering corporate tax rates and accelerating depreciation on capital equipment purchases so companies have an incentive to buy new equipment.

Economic Stimulus Bill Are Temporary

To be successful, any stimulus bill must be temporary since the goal is to shock the economy out of a downward trend and cause individuals and companies to change their behavior.

That is why rebate checks are so popular as a stimulus tool, because it is money in peoples’ pockets that they did not expect and, therefore, are more likely to spend.

In contrast, a permanent change to the tax code is unlikely to stimulate a change in behavior quickly, as taxpayers see no urgency to claim the benefit. Knowing you can sell your house or stocks at a reduced tax rate for only a defined period of time is much more likely to cause one to act.

The Argument for Targeting Benefits to Low Income Americans

Rebate checks, increased food stamps and extending unemployment benefits, while not without detractors, are often viewed as the most straightforward and effective economic stimulus proposals, because they put money into the hands of lower income individuals who spend it on the necessities of life — food, gas, clothes, etc . . ..

Look for future articles on what Congress is likely to try and pass before the end of the year.