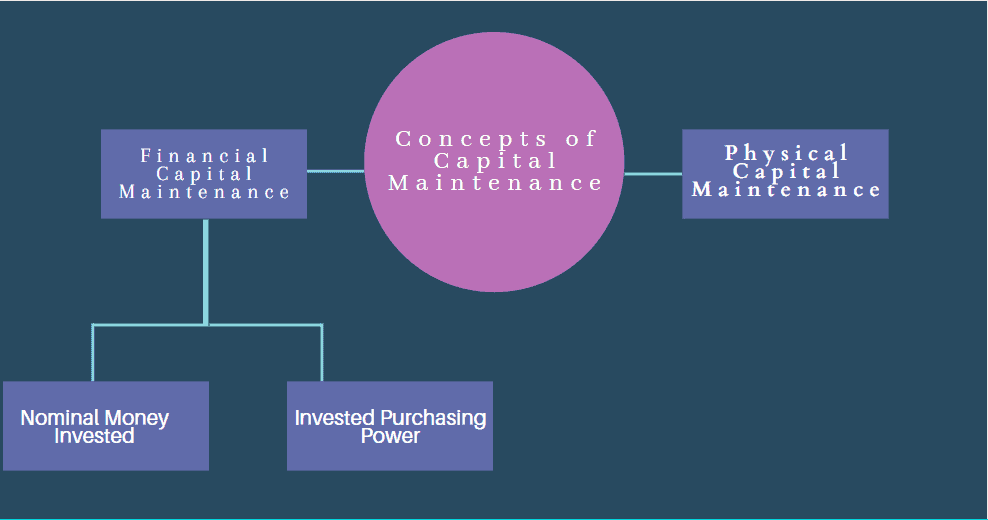

One indicator of whether a business is being well run and also whether the management’s decisions and judgements are working is the concept of capital maintenance. Capital maintenance can either be financial capital maintenance were a business at least maintains the business’ opening capital or physical maintenance were a business produces more products in the current financial year than the previous financial year.

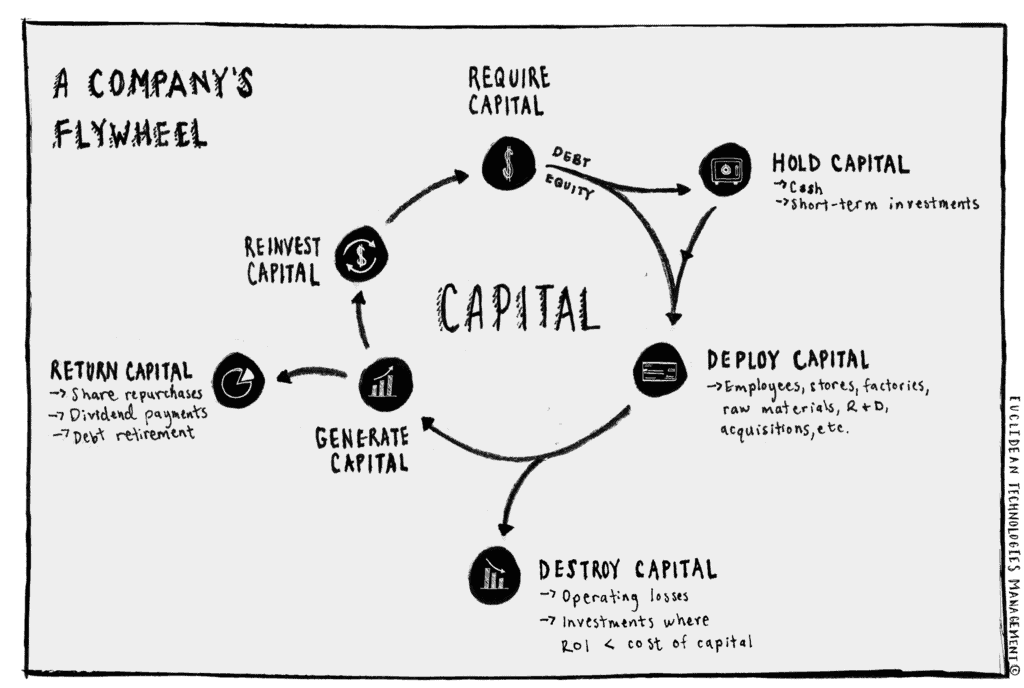

Businesses that continuously increase their sales revenues and efficiently manage their cost structures always increase their capital every year. Such businesses are likely to operate as going concern businesses in the short to medium term.

Struggling businesses always destroy capital and in the long term they will eventually face insolvency or bankruptcy as they cannot sustainably operate in the long term when they are making losses or when they are reducing capital year on year.

Indicators of Capital Maintenance

Capital maintenance can be verified from two main financial statements which are:

- the profit and loss account

- the balance sheet

The profit and loss account can show three different positions depending on how well or poorly the business is doing. The three possible positions are; the business can either make a loss, it can make a profit or it can break even. A break even position is achieved when a business makes a profit of zero and it occurs when the business’ sales revenue or income is equal to the business’ expenses. A business is considered to have maintained its capital if it breaks even or if it makes a zero profit.

If sales revenue or income of the business is greater than the business’ expenses then the business is considered to have increased its capital and if the costs are higher than income or the sales revenue then the business would have made a loss and therefore it would have reduced the capital of the business.

The right hand side of the balance sheet shows the business’ capital sources.

The balance sheet is linked to the profit and loss account as all profits that are generated by the business from its the first trading day eventually appear on the balance sheet as accumulated profit or retained profit. These undistributed profits are also known as reserves.