When you choose to give money to any college, there are many ways you may help the institution.

Alumni Giving

If you are an alumnus from the college, you are actually contributing to improve an important statistic. Each year, the percentage of alumni gifts is computed. This statistic is accessed virtually any time a grant by a staff member or professor is applied for. A very low statistic indicating very few alumni give to the school will sometimes cause the application to be denied.

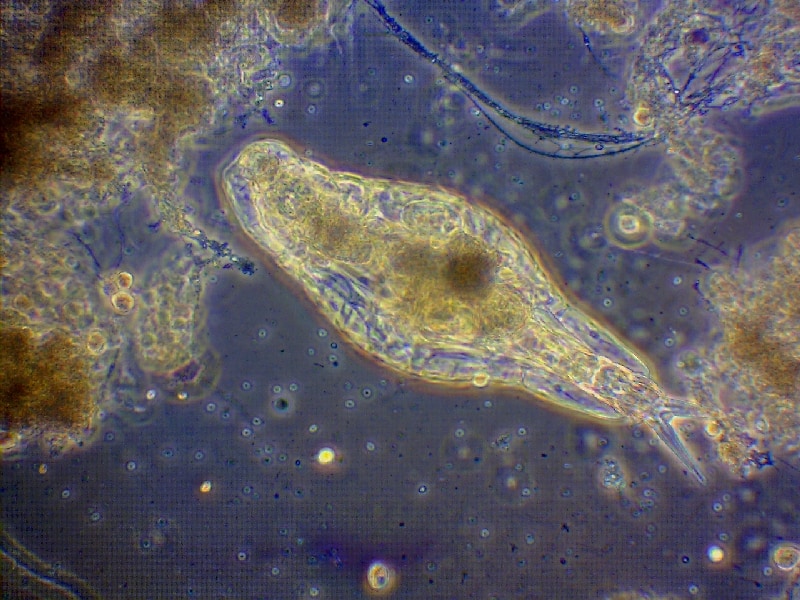

Grant Application Example

A biology professor applies for money from the National Science Foundation to study rotifers. Rotifers are tiny marine animals that are indicators of human behavior. In other words, if pollution is introduced into a marine environment, rotifers will react in the same way humans will. It is cheaper and safer to study rotifers than it is humans.

Unrestricted Donation

When you send a college money and do not state any way the funds should be used, it is an unrestricted gift. It becomes part of the college’s general fund, which is a fancy term for current operating cash. So the college may spend it to help buy new plants for the front lawn or to purchase a secretary’s desk.

Restricted Donation

You really enjoyed English classes in college. You decide to donate $100 for the English department to use as necessary. You have just made a restricted gift. When the college receives your donation, the English department will be notified. The gift will remain restricted until the English department spends the money.

Scholarships

It is extremely common for donations to be restricted for use as scholarship funds. The criteria for scholarships may vary widely from fund to fund. Generally, the Financial Aid department will help each department find qualified candidates for their scholarships. So your donation to a scholarship fund may stipulate you would like an Art student to receive it.

Endowments

Sometimes a donation is made for an endowed scholarship. Let’s say Ms. Smith dies and bequeaths $10,000 of her estate for an Art scholarship endowment in her son’s name. It is to be awarded to promising Art students.

The original $10,000 will be deposited and never used. The income from this donation will consist of three components, which are dividends, interest and gain or loss.

The dividends derived from stock ownership and the interest from investments will be used to award current year Art student scholarships and will be classified in a different location from the original gift.