Term life insurance pays a death benefit to the insured’s beneficiaries if the insured dies within a stipulated time period. Protection is limited to a certain number of years, usually between 5 and 20, and the insurance policy will pay nothing if the insured lives past the end of the coverage term.

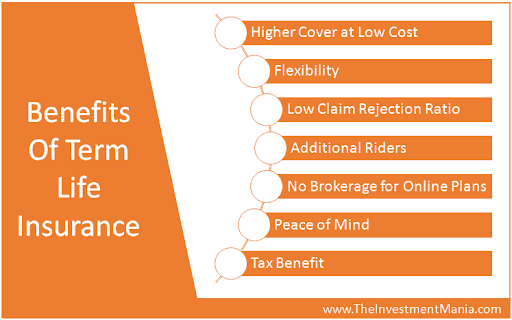

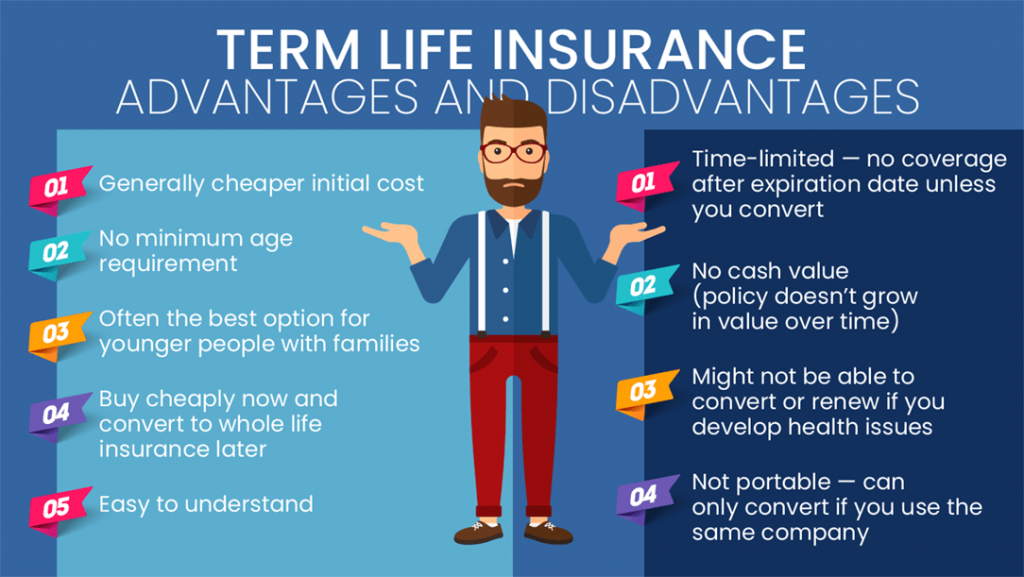

Advantages of a Term Life Insurance Policy

- Term life insurance is easy for the buyer to understand. Unlike permanent protection policies, such as whole life, term life insurance does not build up a cash value and is not considered an investment vehicle.

- Term life insurance is inexpensive. Many young people, just starting out in life, tend to purchase term life insurance instead of permanent life insurance because of the difference in premium.

- Term life insurance is often convertible meaning you can exchange if for a permanent life insurance policy without proving insurability. This is extremely beneficial if the insured has developed any health issues that may affect a new life insurance application.

Disadvantages of a Term Life Insurance Policy

- Term life insurance policies do not build up a cash value. Money cannot be borrowed from a term life policy to help pay off a loan or other expenses.

- Term life insurance is designed to expire before the insured dies. There is a chance, one can pay premiums on a term life insurance policy for 20 years and never receive a dime from the underwriting life insurance company.

Types of Term Life Insurance Policies

- Level Term Life Insurance: The premium and face amount of a level term life insurance policy remains the same throughout the life of the policy, usually 5, 10, 15 or 20 years. Level term life insurance is the most popular type of term life insurance sold.

- Annual Term Life Insurance: The face amount of a level term life insurance policy remains the same while the premium continues to increase. Annual term life insurance policies have the lowest initial cost.

- Decreasing Term Life Insurance: The face amount of a decreasing term life insurance policy decrease each year as the premium remains this same. This is often purchased as mortgage insurance.

Uses of Term Life Insurance

Term life insurance, because it only provides protection for a certain number of years, is often used for temporary needs including to pay off a mortgage or to fund a child’s college education, should the insured pass away prematurely. Due to the initial low cost, term life insurance may also be purchased for the sole reason of protecting one’s future insurability.

Term life insurance provides temporary financial protection for a low initial investment.