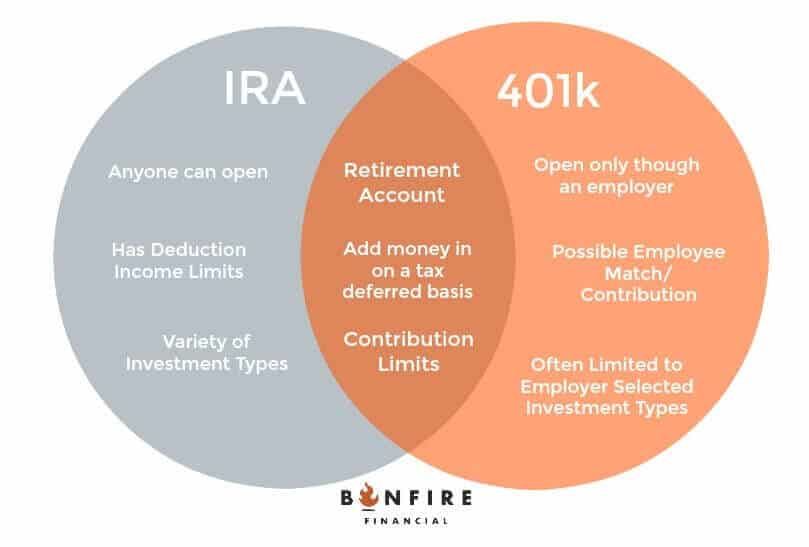

When planning for retirement, many people wonder “what is the different between IRA and 401k accounts?” Individual retirement accounts, also called “IRAs” are offered through financial institutions, while 401k plans are typically provided through employers. Each plan has unique benefits to consider.

Traditional IRA Accounts

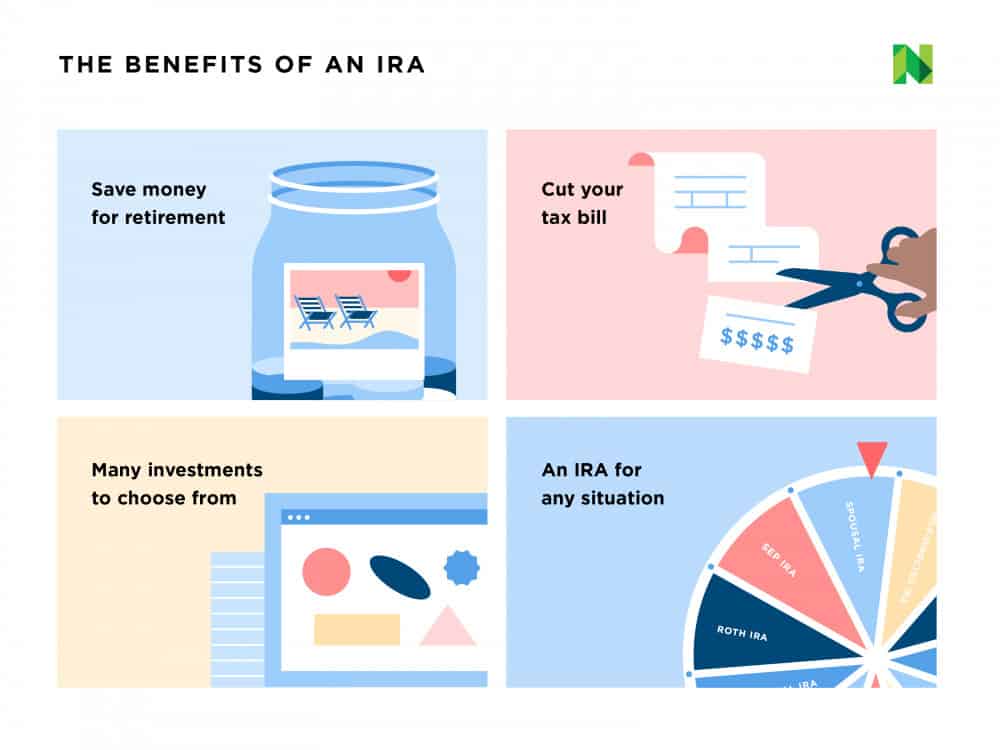

Traditional individual retirement investment accounts (IRAs) allow individuals to make contributions up to $4,000 per year. This amount may be tax deductible, which could minimize an individual’s tax bill. Traditional IRAs are available at banks, credit unions and investment firms and brokerages.

Roth IRAs

Roth individual retirement accounts are another option for investors. However, unlike traditional IRA accounts, Roth IRA accounts aren’t deductible on your taxes. When retiring, however, the account holder cans easily withdrawal funds without being taxed. This account is a good option for people who don’t mind waiting to receive the tax benefits of individual retirement accounts.

401k Accounts

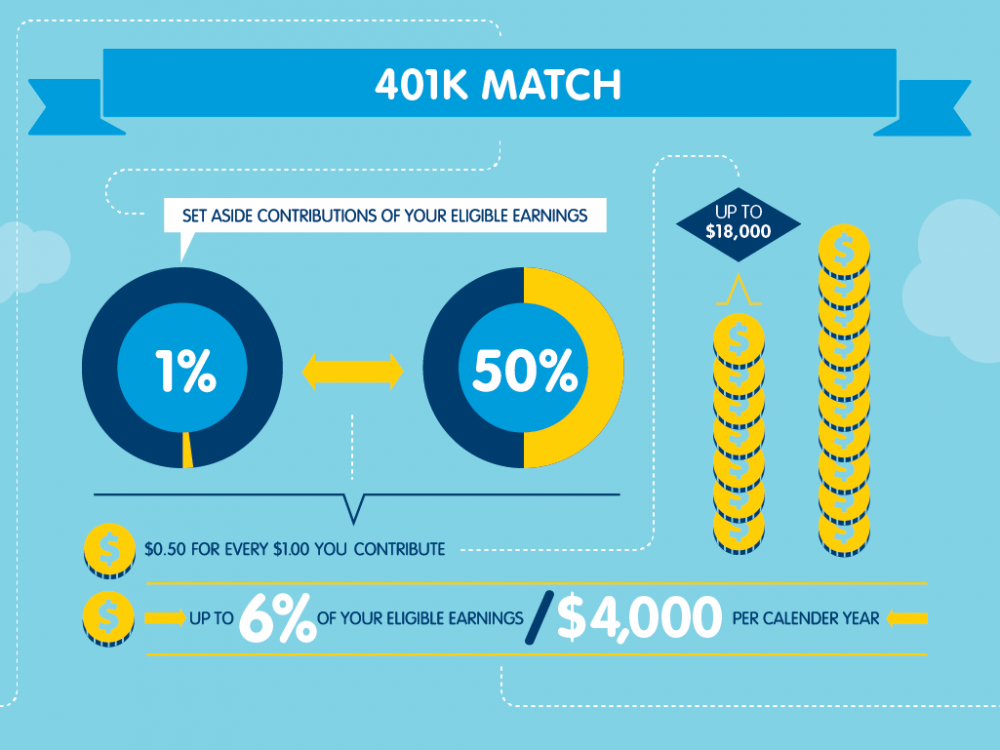

401k accounts are retirement savings plans offered through an employer. Plan participants make contributions directly from their paycheck every month. Some employers match contributions, which is a great deal. For example, an employer might elect to contribute up to 5 percent of the employee’s salary. So, as long as the employee contributes at least five percent, they get the full matching benefit from the employer.

If an employer offers a 401k matching program, employees should take advantage of it. This is “free money” the employer is providing to encourage retirement planning.

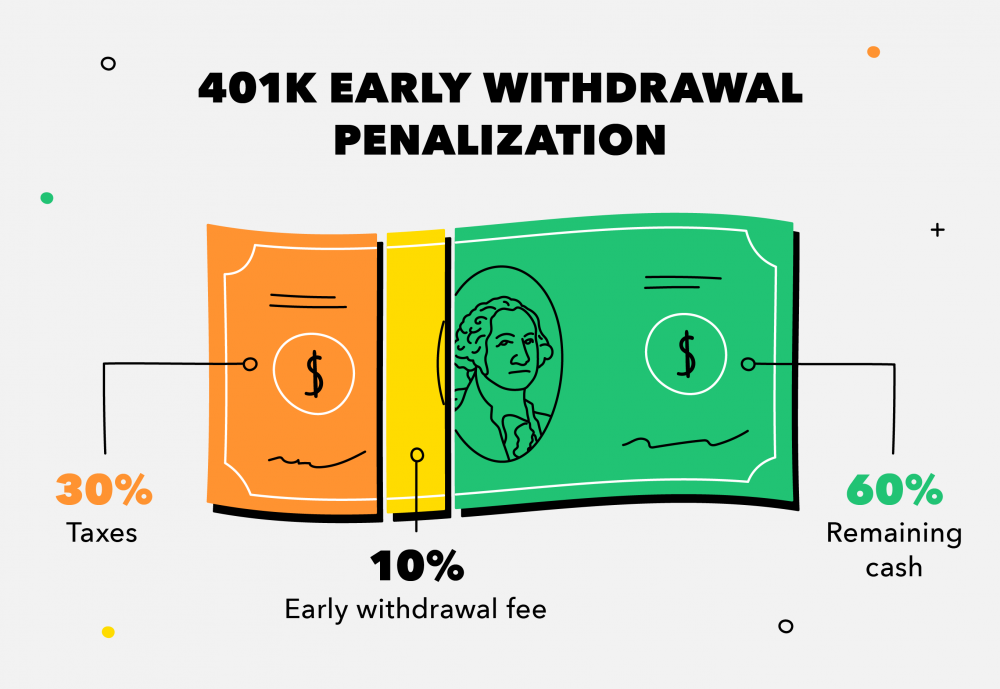

Early Withdrawal Taxes

Since retirement plans are created to promote long-term retirement savings, there are penalties for early withdrawal. If an account holder withdrawals funds before retirement, they might get stuck paying at least 10 percent of the value in penalties (and probably more, depending on individual tax brackets).

However, if an employee rolls a 401k plan into an IRA account, these penalties might be avoided. Consult a tax advisor for more details.

Reduce Tax Liability

Whether an investor chooses a 401k account or an IRA, it’s important to minimize tax liability. To accomplish this, maximize annual contributions each year. As time passes, savings will quickly grow into a very nice retirement nest egg.

When evaluating the difference between IRA and 401k accounts, it’s important to consider long-term savings goals. For people who have access to 401k accounts (with an employer matching contribution plan), it’s wise to take advantage of the program. IRAs don’t offer employer backed contributions like 401k plans provide. IRA and 401k plans, however, are both a solid method for socking away investment dollars.