Almost every business course or investment appraisal report will make a reference, at some point to the payback period of a project. In short, the payback period is one of the simplest and most popular investment appraisal tools however, it may not always be the best tool for the job.

What is the Payback Period and How to Calculate the Payback Period?

The payback period quiet simply asks the question “how long will it take for a project to pay back its initial investment?” As such, in order to calculate the payback period, all that is required is a knowledge of the initial amount to be invested and the expected cash flows of the project.

Once this information has been ascertained, the cash flows of the project are added together to form a cumulative cash flow. When the cumulative cash flow becomes equal to the initial amount invested, then the project is considered to have been paid back.

Cash Flow

- Year 0 (£15,000)

- Year 1 £5,000

- Year 2 £5,000

- Year 3 £5,000

- Year 4 £5,000

Cumulative Cash Flow

- Year 0 (£15,000)

- Year 1 (£10,000)

- Year 2 (£5,000)

- Year 3 £0

- Year 4 £5,000

Thus in the example above, one can see that the project has a payback of three years. In general terms, projects with a shorter payback are preferred to those with longer payback periods. Additionally many organisations will have a fixed “hurdle rate”, a hurdle rate is the maximum length of time that that a project will be allow to continue, before the project must have paid back. Projects which have a payback beyond the hurdle rate will be instantly rejected.

What are the Advantages and Disadvantages of the Payback Period?

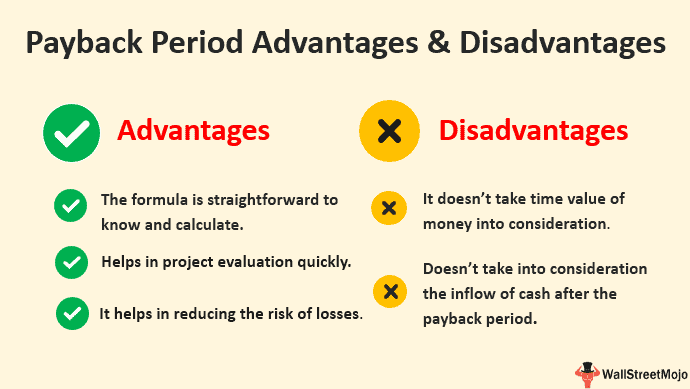

The main advantage of the payback period is the simplicity of the model. The tool takes relatively little time to use, is easily interpreted and readily explained to other stakeholders, even where such stakeholders have little or no financial training.

Despite the tools major advantage of simplicity, this may also bee seen as the underlying weakness of the model. The issue is that undiscounted cash flows see that the time value of money is completely ignored. This can be rectified by using an adaption of the model, which makes use of a discounted cash flow. However, in such a circumstance then NPV may be a better tool to use.

The other major disadvantage of the payback period is that it ignores the total value of a project. As such, some projects may be rejected because they have too slow a payback, even though they may be more profitable than other projects with a shorter payback period.

In summary, the payback period is a great tool to use, where a simplified investment appraisal tool is required. However, in many circumstances it may be better to consider using a more complex method, such as NPV.