The answer is not simple in a short sale. Currently there is no unified protocol; however, lenders must go through certain criteria. All properties have a value less selling assets or borrowing. Neither, for all lenders is required to provide offers.

31 days delinquent borrowers to their mortgage note to an essential minimum criteria for short sales. Loan and property value of the borrower enjoying the assets that can be used to repay the loan balance is less than should be.

“Short selling means that bank borrowers on your loan to allow them to sell the property. Short sales are usually only when all other methods those are available for a mortgage was recorded. It is important to understand that when they enter there is no longer eligible for short selling. Therefore, it is important that borrowers contact their lender when they are unable to continue making mortgage payments.

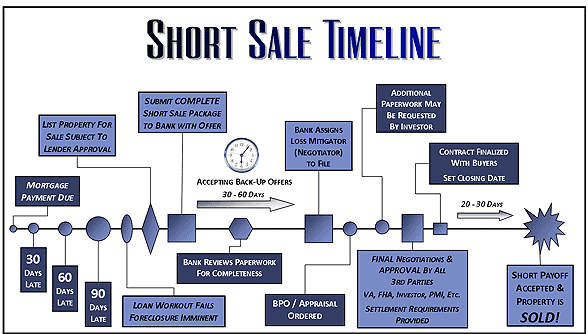

Short sales are handled by the department of lender loss mitigation. Borrowers default on their loans, the attenuator loss is assigned to your account. To help solve the crime the person is responsible for the borrower. He did not approve or disapprove an application for short sale. Instead, they act as an intermediary for the borrower and lender.

Lenders, borrower’s events materials which are generally required to submit a document describing a crime in the short sale. And borrowers to get short sale hardship letter to be careful of handicrafts is an important component of a permit.

To extend financial difficulties, including the choice of time, the measures taken to remove events with cushion the loss of the handwritten letter. Borrowers who lose their jobs or who have medical problems are engaged in a fruitless expenditure are appropriate to allow more lenders.

To complete the short sale process takes four to six months. Financial audit, and submit documentation to the attenuator loss by a number of borrowers are required. Some banks require borrowers in short sales are allowed to give the buyer the first place. Further to the borrower a real estate agent to list your property will allow.

When a property is listed by a realtor, banks, buyers are usually located in a few months grace period. If the property is sold within a specified period, the lender will begin foreclosure proceedings.

Last but not least, it is important to determine what type of selling is offered by lenders. The lack of research and totally the decision by the judge with pay: There are two types of short selling.

Borrowers in repayment of the full press of the sale price and loan deficiency payments, the balance. Deficiency judgment, the borrowers are required to repay the debt. It can take years to pay a large sum could be. Credit report from the borrower to decide on full pay.