Is there an official retirement age for Americans? Not really. But, when you choose to give up work matters as this can affect your income and benefits.

Knowing when you are likely to make the transition from work to retirement is important. In an ideal world, this allows you to plan ahead and to build up the savings you need. Although the age at which this happens may be up to you, there are certain milestones that you have to reach before you can claim some benefits and income. Plus, when you retire could impact on how much money you get. What do you need to know?

Is There an Official Retirement Age for Americans?

Generally, you can choose to retire when you like. There isn’t one specific age when everyone stops working (unless you work in a job with mandatory retirement rules). But, the benefits you are given by the government and the income you receive as a retiree can be age-based. So, you can give up your job as early as you want, but you may need to find replacement income until you become eligible for these payments.

When Can You Start Claiming Social Security?

If you’re eligible for Social Security, you can start claiming when you are 62. This is, however, considered to be early retirement and the payments made will be lower than if you wait until the normal/full retirement age. This is being gradually increased at the moment from 65 to 67. If you wish, you can, as an alternative, delay taking benefits which will increase your payments (up to the age of 70).

When Are You Eligible for Medicare?

Medicare is available from the age of 65, unless you are disabled or have permanent kidney failure, in which case you may become eligible sooner. If you are considering retiring before this point, you may need to organize your own healthcare coverage until benefits kick in. If you choose not to claim Social Security at the full retirement age, you should still look at applying for Medicare as signing up later could increase your costs.

When Can You Take Money Out of 401(k)s and IRAs?

Your contributions to retirement plans are designed to provide income for later life. So, although you can technically access your money before you retire, this could incur penalty charges if you use it before the set minimum age. This is currently 59 ½ for 401(k)s and IRAs. There are some exceptions – you can, for example, make penalty-free 401(k) hardship withdrawals and take cash out of an IRA/Roth IRA with no additional charges in certain circumstances.

How Will Early or Late Retirement Affect Your Income?

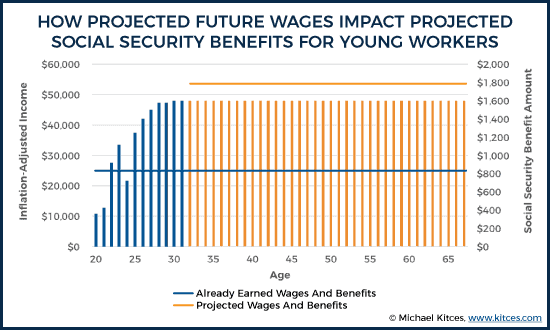

If you decide to retire early then you do need to work out what you will live on before you become eligible for benefits and income. It’s also worth considering how not working will affect your finances in the future. If you have a period when you aren’t in the workforce, you may end up with lower benefit and income levels if your contributions come to an early end.

Plus, if you are forced to dip into retirement plans, you will erode the money available for later years. Taking Social Security at the earliest possible age will also give you a lower payment for the rest of your life than if you wait to make a claim. Retiring later could give you a different financial outlook.

Deferring retirement may give you the chance to build up your long-term savings and to maximize benefit payments. In addition, if you claim Social Security later, you will be paid higher amounts which can help increase your overall income.

Some people are forced into retiring earlier than planned; others choose to stop working at a younger age than is the norm. Nowadays, it’s also becoming more common to work for longer, either through choice or through the need to boost income. Thinking hard about the financial implications that come with different retirement ages is an important part of the planning process for later life.