Some companies offer matching 401(k) retirement plans, profit-sharing plans, or an employee stock option plan. Employees would be very wise to take advantage of the free money offered to them through matching from the employer. However, employers don’t always set up the account to dole out the free money right away; they often compensate employees a little at a time over a few years in a program called vesting.

What Is Retirement Plan Vesting?

Vesting is a financial term used to describe the way a company distributes its matching 401(k) retirement plan funds to employees. Rather than giving employees a heap of money all at once, employers would rather delay this incentive as a means to award, retain, and motivate workers.

In effect, the employer is dangling the carrot of a sizable lump sum of money in the face of the employee in exchange for several more years of hard work.

How Does Retirement Plan Vesting Work?

Vesting occurs when the employer matches funds in an employee’s 401(k) retirement plan and places those funds on a vesting schedule. The vesting schedule determines when the employee can expect a full payout of employer-provided matching funds and how much he or she should expect on an annual basis.

In theory, workers will see this potential money and will be encouraged to stay at the company in order to receive the full amount.

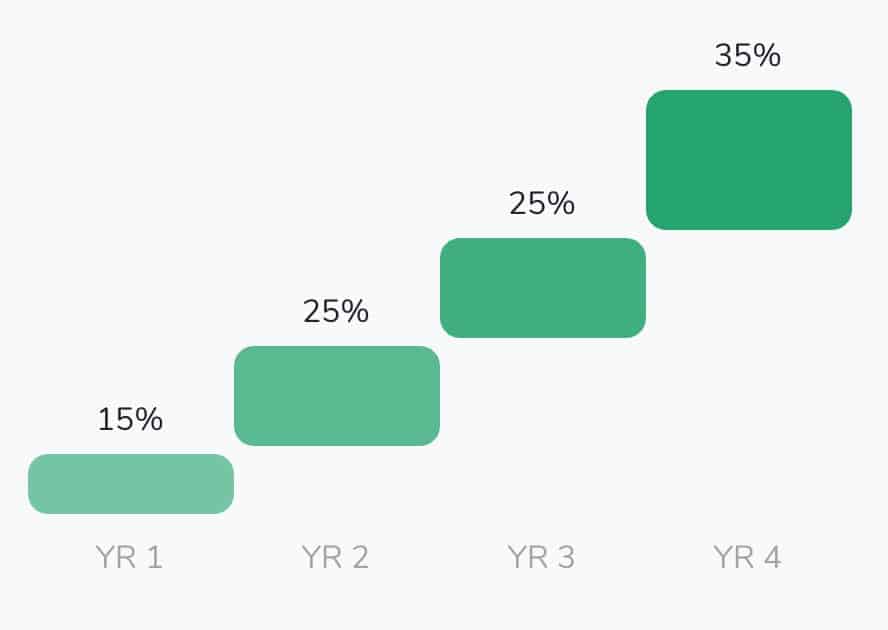

For example, a company that offers a profit-sharing 401(k) retirement plan may set a vesting schedule of four years for 100 percent vesting. This means that over four years, employees receive a certain percentage of the profit-sharing funds annually, but not all at once.

However, after the seven-year period is up, the person is 100 percent vested. At this point, both current and future profit-sharing funds are immediately distributed in full to the employee.

- What Is Aromatherapy Vs. What Are Essential Oils?

- What is La Tomatina in Bunol, Spain Like? What to Expect at the Famous Tomato Throwing Festival

What Are the Types of Retirement Vesting Plans?

By law, employees are automatically 100 percent vested in their contributions to any retirement plan, be it IRA, 401(k), or 403(b).

However, employees in an employer-sponsored vesting plan do not necessarily retain full ownership of matching employer funds. The employer may elect to proceed with their vesting plan in one of three ways:

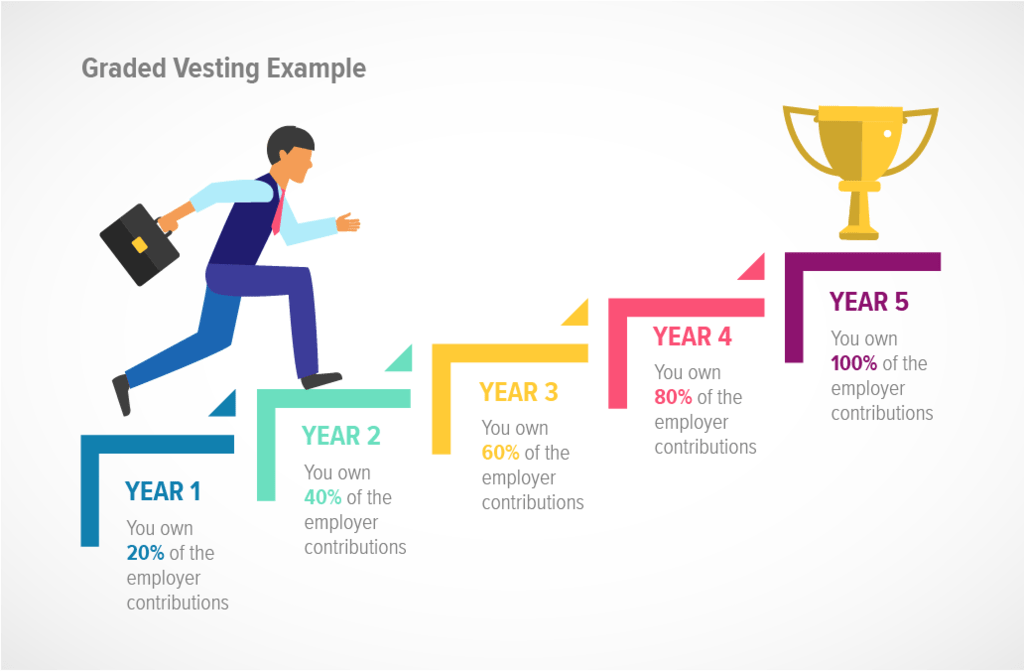

- Graded vesting. The most common vesting method, graded vesting means the employee receives ownership of matching funds gradually over a period of years. At the end of the vesting schedule, the employee retains 100 percent of current and future matching funds.

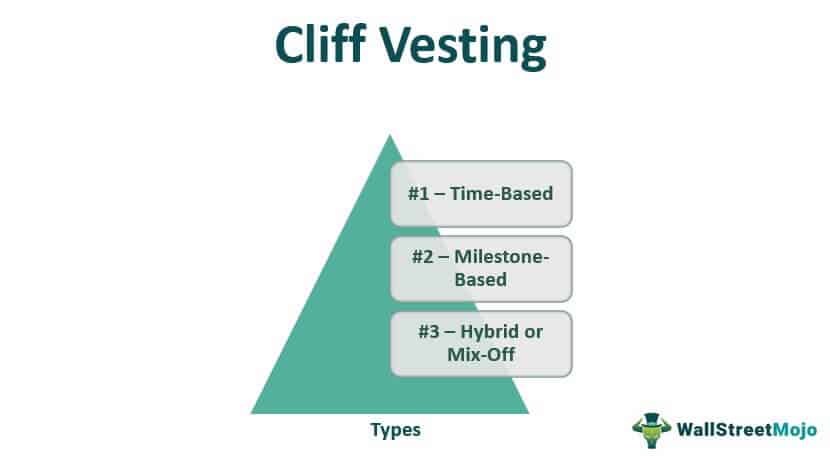

- Cliff vesting. Employers will sometimes opt to withhold the entire amount of matching funds until a specific length of service is completed. If the employee stays, he or she receives the full matching amount. However if the employee leaves the company, all matching funds are forfeited.

- Immediate vesting. Employees taking advantage of a 401(k) retirement plan with an immediate vesting schedule gain 100 percent ownership of their employer’s matching funds immediately without delay.

The Bottom Line on Retirement Vesting Plans

Bottom line, retirement vesting plans serve to encourage employee retention while at the same time providing employees with a monetary reward for their hard work.

Employees with a graded vesting plan gain ownership of matching funds over time, while those with a cliff vesting plan won’t get any money if they leave the company before they are 100 percent vested. However, as with all vesting plans, once the person is 100 percent vested, all future matching funds are immediately distributed.