Forex or the foreign exchange market is a market of currencies across the world. It is decentralized and accessible to all: when a tourist in Tokyo buy U.S. dollars with Yen, it performs a transaction in the forex market – just as when a multinational converts millions of euros into sterling. This makes it the largest market in the world, rendered very volatile by the large volume of transactions; It is also open at all times, except at weekends.

Well the forex clients seek only to Exchange foreign currency against their, such as companies that need to pay wages elsewhere than where they sell. But a large part consists of resellers of currency who speculate on movements of exchange rates – like those that do on the evolution of the price of the shares.

Whorush: 4 sites by this AdSense ID

Exchange rates fluctuate because of facts and events macroeconomic as well as expectations that have traders in addition to actual cash flow. This market attracts private investors because its volatility offers many opportunities of profits (and losses, of course), while allowing use of hedging instruments well known. Another advantage is that the forex broker allows the use of leverage by their investors by requiring that margins.

On the forex market, foreign currency exchange with each other in “pairs”, which represent the relative of a value of a currency, the “base” unit, against another currency, the “against”. They are generally written by juxtaposing three-letter currency codes, starting with the base; for example, EUR/USD refers to the report of the euro against the US dollar.

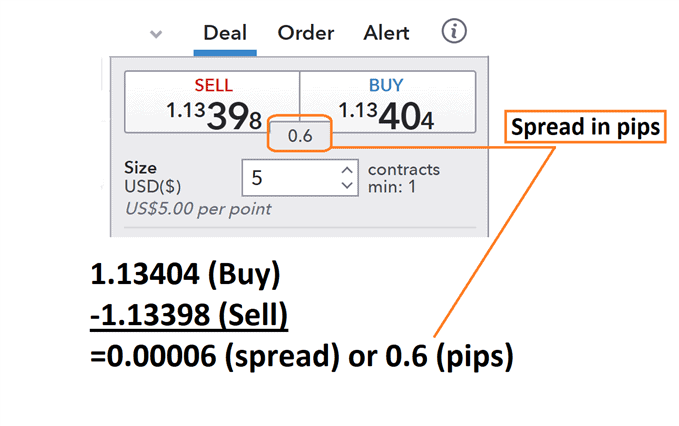

As on all markets, there is a difference between the purchase price and sales on the forex, called gap between demand and offer. It is measured in “pips”, the smallest difference in price that a given exchange rate can offer – and generally equal to 1/100 of a percent. For the major currencies, the difference between the price at which a player in the market will buy (“application”) to a client, and that it will resell (“offer”) is often between one and three pips.

The market is divided into three levels of access: at the top is the inter-bank market, comprising the largest banks and securities dealers. who generally see sharp differences. Smaller banks and large multinational corporations come after, followed by pension funds and asset managers. Traders, close walking, participate indirectly through brokers or banks, and are a part of market booming through the facilities offered by the Internet.