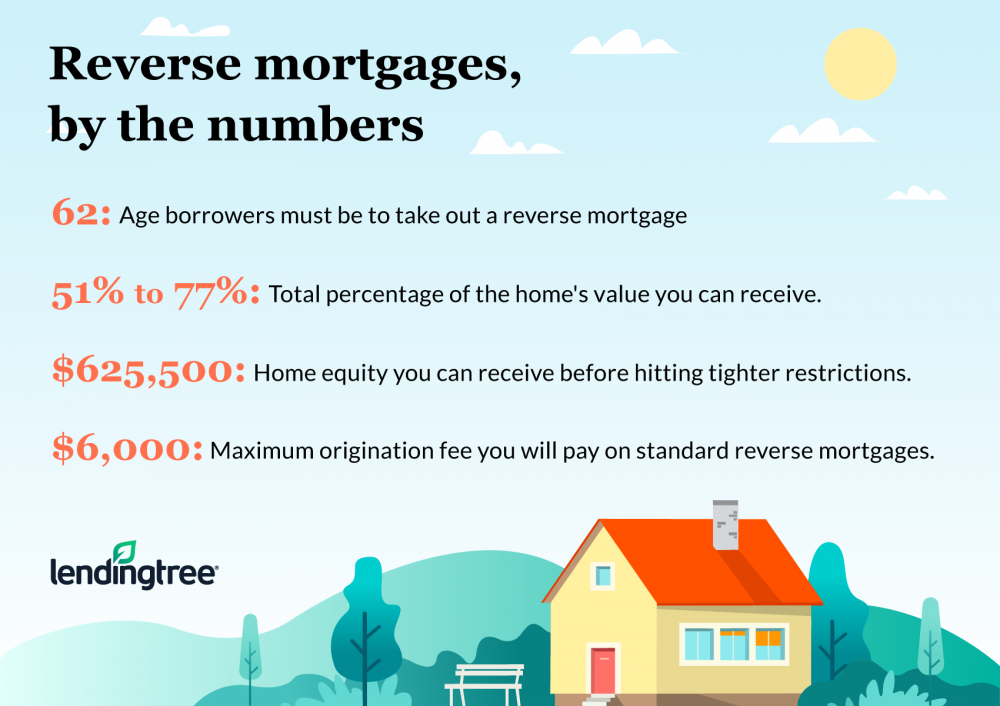

A reverse mortgage is a loan taken out against your house that is not repaid until you die, sell your home or move. A common type of such a loan is the Home Equity Conversion Mortgage insured by the Federal Housing Administration. HECMs are available to homeowners who live in their home and are 62 or older.

Receiving Payments

The primary reason for taking out a reverse mortgage is for retirement income. An HECM allows you to take the retirement income as a single lump sum, monthly payments, or as a line of credit from which you can borrow any amount needed up to the available limit of your credit line. The monthly payment feature best illustrates why this product’s name is a reverse mortgage. With a traditional mortgage, you borrow a large amount to purchase a house and pay it back over time, in monthly payments. With a reverse mortgage, you get the monthly payments.

Selecting A Payment Option

The credit line and monthly payments have features and options. The unused portion of the credit line will increase each month by an amount specified in your contract. The monthly payment option can be either a fixed term or a so called “tenure” plan, in which you are paid until you die or move from the house. Payments for the tenure plan are lower than a fixed term. Also, the older you are when you start the program, the larger the amount you can borrow.

Program Costs

An HECM has five different types of costs associated with it: origination and servicing fees, closing costs, mortgage insurance premium, and interest. The origination fee and servicing fee are what the lender charges for the administrative work involved in your loan. The origination fee is paid upfront and is capped at $6,000. The servicing fee is a monthly fee, capped at $35. Closing costs are similar to those in a traditional mortgage, and include such items as a title search and an appraisal. The MIP is a premium for federally backed insurance that guarantees you will get the money you are entitled to. It also guarantees that your total debt will not grow above your home’s value. The MIP has two components – an upfront fee of two percent of your home’s value and an on-going fee of 0.5% of your outstanding principal. All of these fees can all be financed through the HECM and so do not need to be paid out of pocket.

Interest

Interest is by far the largest expense of an HECM. It significantly exceeds even the total of all the other fees. The amount of interest you pay will depend on how long you live in your home and your interest rate regime. The two broad categories of HECM interest rate regimes are fixed and adjustable.

Fixed Rates

A fixed rate is a guaranteed rate for the duration of the HECM. This arrangement can result in a higher interest rate, because the lender does not know how much you will borrow or when you will pay it back. Although a fixed rate provides a guarantee, AARP argues consumers may pay too much. Some reverse mortgage fixed rates exceeded 15 percent.

Variable Rates

HECMs are also available with rates that adjust on either an annual or monthly basis. The prevailing market interest rates determine the rate, which can adjust up or down. An annually adjusted rate has some guarantees for the consumer, including a maximum two percent increase in a single year, and a maximum increase of 5 percent over the initial rate. A monthly adjustable rate does not provide these guarantees, but is likely to be the lowest rate available when you first establish your HECM.