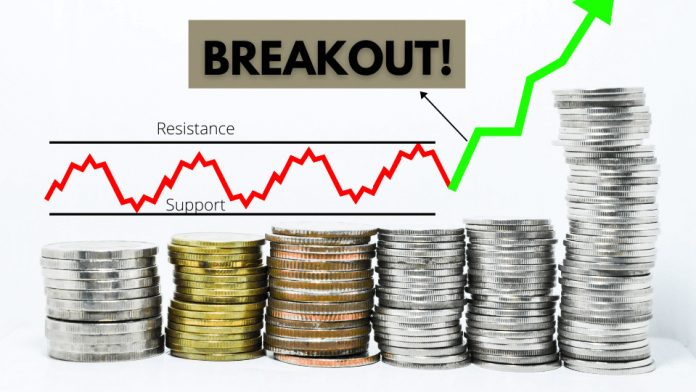

Breakout in stock trading is a phenomenon that occurs when a security’s price increases past a level that it was unable to beat in the past. This can mark a time to buy into stock when conditions are right, as opportunities to sell later for more will arise if price keeps increasing.

The following is some advice on trading according to breakout in investing.

What is Breakout in Stock Trading?

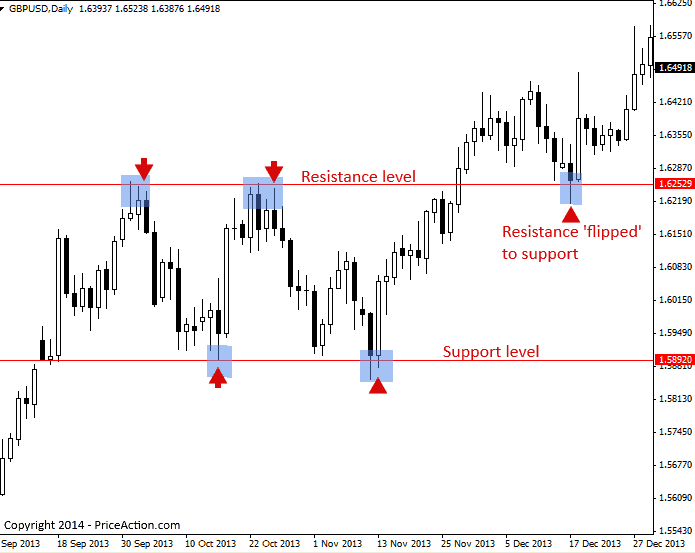

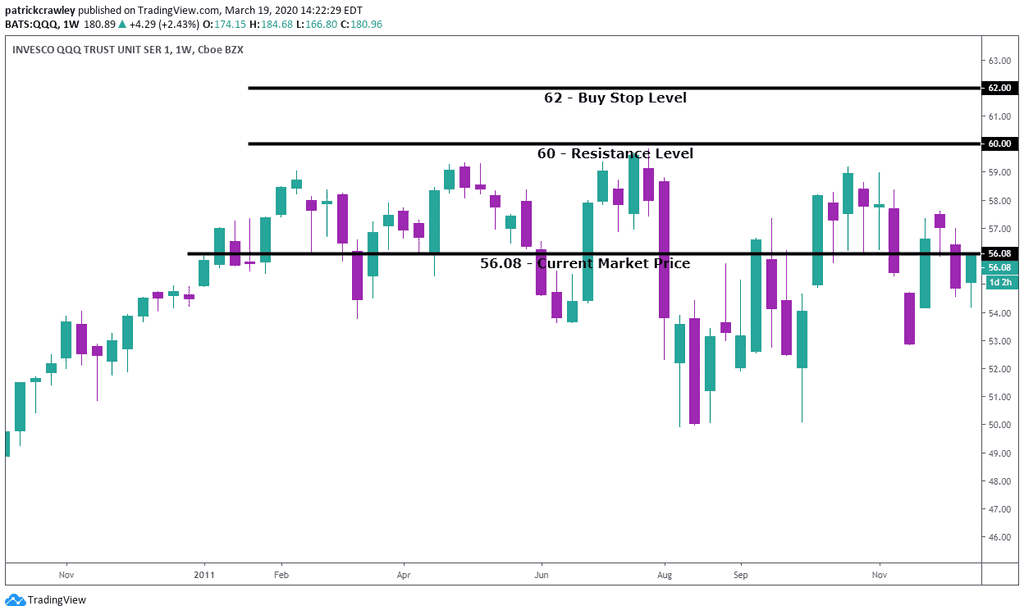

To realize breakout, one must first be able to recognize resistance. Resistance is a price level that a stock has reached or gotten close to several times over a period, but been unable to really rise up from.

It is as if a security has a leash which prevents its price from rising up past a certain level (the resistance level), keeping it steady or pulling it back each time it tries to rise past this mark.

Breakout is the stock’s actually beating an established resistance level. Suppose that a stock had, over months, hit or gotten very close to $15 several times, but it had failed to climb up much from there. That would make $15 the resistance, and if it finally broke free with upward momentum that drove it up past $15, it would be experiencing a breakout.

See more What is Resistance in Stock Trading?

Stock Trading and Breakout in Investing

It takes a significant amount of momentum to push a stock past its resistance level. Often, when this happens, the same upward momentum that forces a stock beyond the point that it could not exceed in the past is enough to maintain the uptrend, and push the price even higher.

If an investor can predict the right time to buy above the market (after a stock beats its resistance level), shares can be taken on early after an increase, that will keep the price rising, seems to have been established.

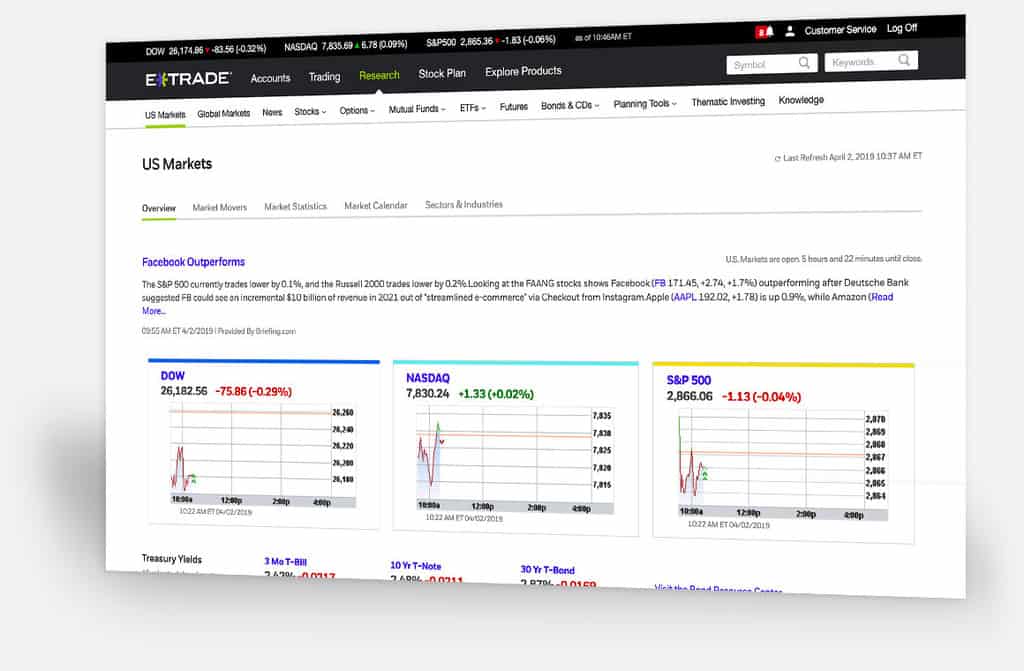

To find resistance level for stock, traders can refer to free charts at discount trade websites like E-Trade, Scottrade, TradeKing, and TD Ameritrade.

Then, setting a buy stop order just above resistance level (but high enough above this price that such a breakout seems to indicate a continuing rise, instead of another drop after the stock barely beats the resistance level) can be very wise.

Especially if there are any positive news reports or other phenomena that can boost a given security’s price, buying just above the resistance as a stock breaks out can lead to profits, as the same momentum that caused the value to rise past a level that it could not beat in the past will very likely carry the price higher, and shares can be sold later for more if an investor is right in predicting that the breakout indicates a continuing price increase after the buy.