Original Medicare won’t necessarily pay for all the health care coverage you need. Supplement insurance may help with copayments, coinsurance & deductibles.

Your Medicare coverage is unlikely to pay for all of your health care costs. Many seniors will take out private policies (known as Medigap or Medicare Supplement Insurance) to pay these additional charges. How does this work and what is covered?

What is Medigap?

This private insurance plan supplements Original Medicare. It is designed to be added to basic coverage to give protection for any gaps where payment may fall to the individual. You do not have to buy a policy, but many choose to do so to avoid paying extra when/if they need treatment. Plans are only available to those with Part A and Part B and will not deal with gaps in Medicare Advantage Plans.

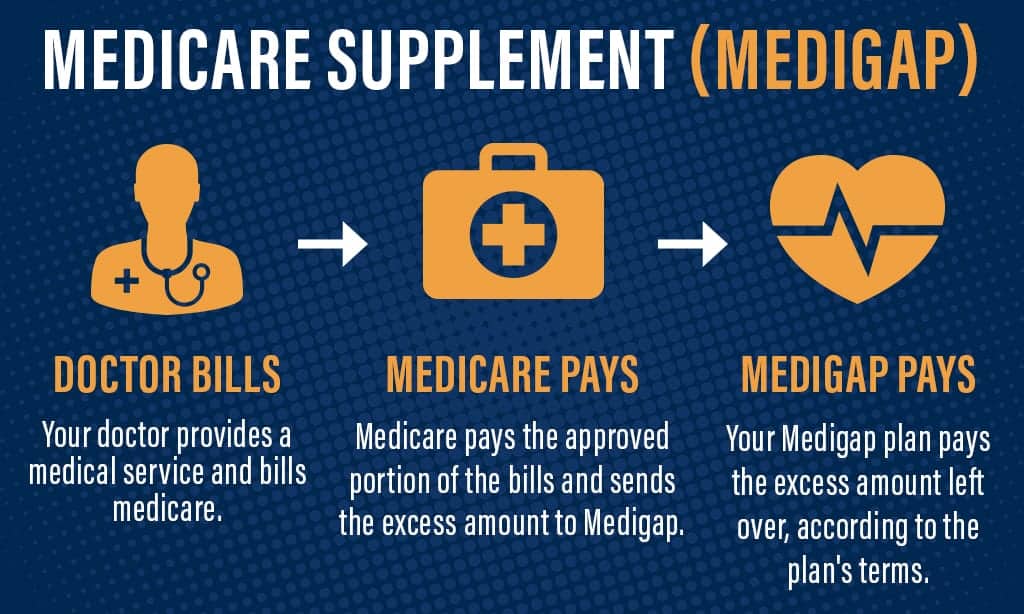

How Does a Medigap Plan Work?

You have two choices if you need to pay for supplementary health care gap costs under this system. You can pay out of your own pocket or you can use a Medigap plan. In the latter case, your plans will work together: Medicare covers its allowable costs and Medigap then pays for some/all of the charges that you would normally have to deal with. If you don’t have this insurance supplement, then all these costs have to come out of your pocket.

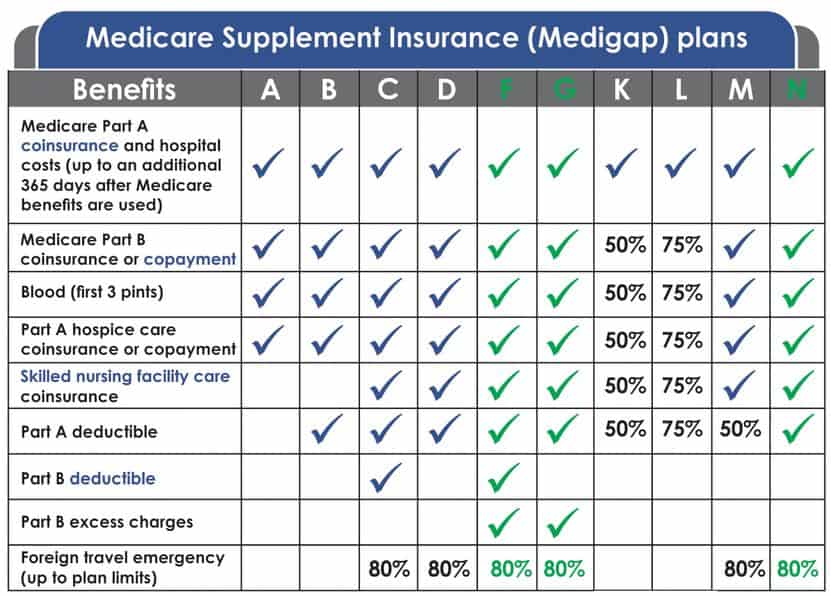

Plans are regulated by federal and state laws and follow a specific benefits structure, classified by letters (A to N). Note that E, H, I and J policies are no longer sold but are still valid if purchased before June 1, 2010. The actual benefits given will depend on the plan number you choose and/or the options available in your state. Not all plans are offered in all regions, and Massachusetts, Minnesota and Wisconsin operate a different system altogether.

What Does Medicare Supplement Insurance Cover?

Medigap is designed to deal with costs such as copayments, coinsurance and deductibles. Some plans offer extended benefits, such as medical insurance for people traveling outside the U.S. (foreign travel emergency). All options cover basic benefits, such as Part A coinsurance and hospital costs, once Medicare runs out (for an additional 365 days) and Part B coinsurance and copayments. Others will come with additional features.

What Does Medicare Supplement Insurance Cover? Image by safeguardky.com

In some cases, benefits will only apply for a percentage of costs; in others, full costs will be met. Generally, you will pay higher premiums to get more features. Although coverage (as denoted by a plan letter) will always be the same, costs can vary. It’s therefore worth shopping around and comparing costs from different insurance companies as this can save money.

It is important to think hard about the advantages and disadvantages of Medigap and the type of coverage you need before you buy a plan. Keep in mind that the costs of some coinsurance, copayments and deductibles have been recently removed through other Medicare initiatives (e.g., free annual wellness visits), so you may no longer have to factor these in.