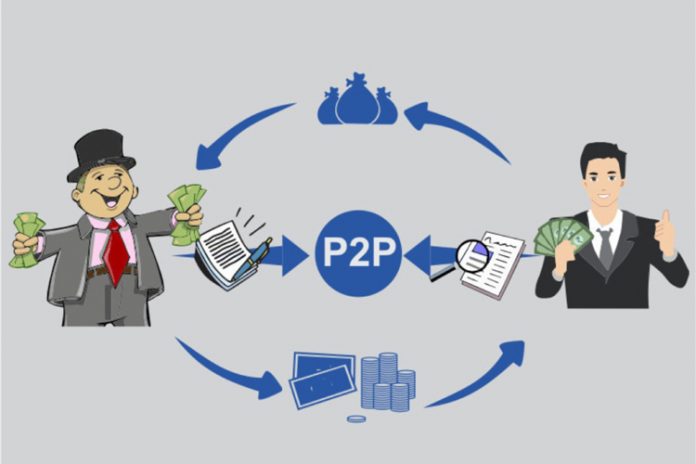

As the process of lending and borrowing through the traditional methods of banking systems grow tougher, consumers are now exploring new sources of funding. In the financial marketplace, peer-to-peer lending is establishing its ground as a commonplace solution to traditional methods of finance.

In simple terms peer-to-peer lending are for profit loan agreements that are established between individual lenders and borrowers. The loans are managed by licensed broker-dealers. The Broker licenses are obtained through the Securities and Exchange Commission and the notes filed are accepted as legal transactions.

Borrower Qualifications

Similar to traditional lending, peer-to-peer borrowers complete loan applications that are evaluated and qualified by broker-dealer service providers like the Lending Club and Prosper Loans Marketplace. The primary benefits in peer-to-peer lending for borrowers are lower interest rates and less formal application processes. Similar to traditional banks, borrowers are still required to submit complete loan applications, provide information such as work history, income, and current expenses. The borrower’s social security number is obtained during the application process for credit verification. The application results are shared with potential lenders.

The service providers share information to potential lenders about the applicant’s credit score, loan amount requested, purpose for the loan, and the overall applicant risks. Communications between potential lenders and borrowers are within the network platforms of the service providers and can be either formal or informal. Loan approvals are based upon and determined by the individual lender’s. Management, Fees, and terms of the agreement are handled by the service provider, including verifications, contracts, collection of payments, and distribution of funds.

Benefits for Lenders

The benefits of peer-to-peer lending for potential lenders, including profit growth and opportunities to invest in consumer credit. Peer-to-peer lending is a business anyone can join and the minimum investments are reasonably low. According to financial information reported on the Lending Club website, average returns range between 6 and 18%. Service providers make money from the transaction fees collected from notes bought and sold. Notes can be bought and sold anytime.

Peer-to-peer service providers offer a hassle-free and convenient management structure for potential lenders. Service providers take on the tasks of managing the day-to-day operations, overhead expenses, and customer service. Peer-to-peer lending is a window of opportunity for those looking to venture in business ownership and investments with minimal commitment.

Peer Lending and Social Network

Peer-to-peer service providers typically operate through social network platforms. Relationships between potential lenders and borrowers can be preexisting or new. Some relationships are family and friends, others only connected through common or professional interests. In some cases, the relationship is completely anonymous. The premise is that the risk of loan defaults are minimized when there is mutual connection between the parties.