Choosing the kind of life insurance one needs can be a difficult decision. Many people procrastinate on purchasing it because the thought of one’s mortality can be upsetting.

However, people must confront that they will die one day, and that everything they did before that time will make up the legacy they leave for others to remember them by, including the financial state in which they left their family.

Defining Whole Life Insurance

The State Farm website defines whole life insurance very simply. So long as people maintain their premium payments, their beneficiaries will receive the money the policy promises.

For example, If a 27-year-old man purchases $100,000 worth of life insurance today, he may be required to pay $150 every month for the rest of his life. If his life ends next month, his family will receive the full policy amount of $100,000, just as they would if he passed away at the age of 80.

Cash Value in Insurance Policies

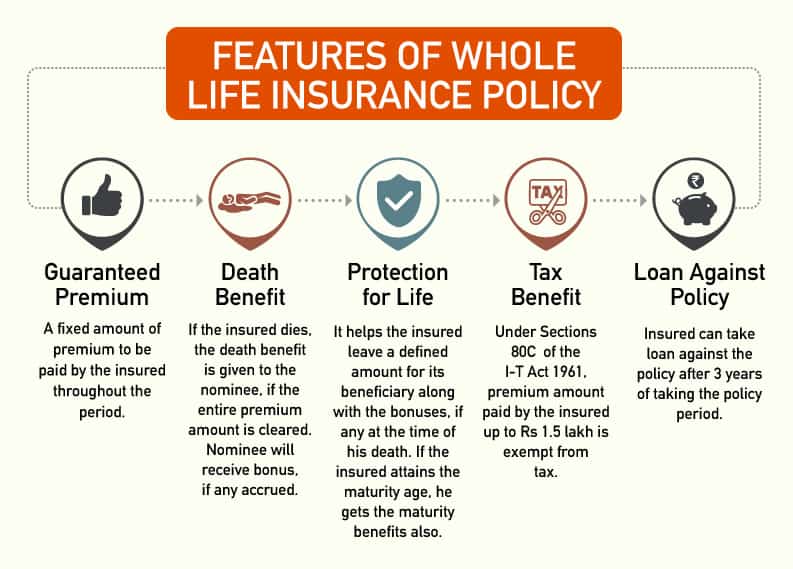

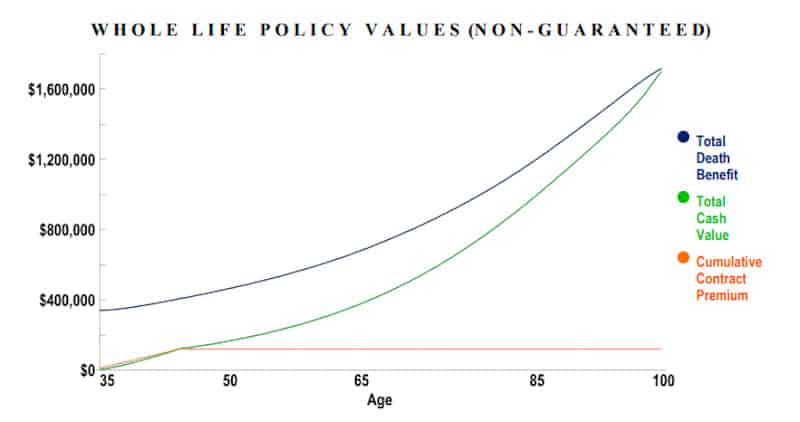

While it is true that whole life insurance policies have a significantly higher premium than term life insurance, they also have the benefit of coming with a cash value part in the plan.

As premiums are paid, part of the money is saved in a separate account. This money can be borrowed against in times of need, but, more importantly, it will be paid out to equal the full value of the policy if the insured person reaches the age of policy expiration, which is usually 95 or 100 years of age.

So, if a young man purchases a $100,000 policy today and lives to the age of 95, he’ll receive his full benefit before his death. It might not stretch as far as it would have when the plan was first purchased, but the peace of mind of leaving one’s family with the added security that the policy would have offered had probably added a few years to his life by way of having reduced financial worry.

Dividends With Whole Life Insurance

Companies like New York Life pay dividends to policy holders time and again. They are not guaranteed, but they do occur. The dividends can be used to pay part of a policy holder’s premium. Other options are for them to sit in an account gathering interest, or be paid out in cash.

While receiving dividend payments from one’s life insurance company may seem strange, it does occur with whole life policies; policies that offer a lifetime of security that is backed up with cash paid into them over many years so that even in their expiration, policy holders receive the benefits they signed up for when they acquired the policy.