It was not shocking to know that in a survey in 1998 showed that even of the literate world population, not more than 17% knew what life insurance means. Of course due to the media, technological progress, greater awareness programs and easier means of communication, now the proportion is much higher than previously.

Life insurance is actually an agreed sum of money that is assuredly given to the selected beneficiary or receiver in the circumstance of death of the person who has signed the insurance agreement.

The beneficiaries are mostly children, siblings or spouses; children being the most common among them. The total return is given in exchange of monthly (time period depends on the agreement and is negotiable) insurance premiums that are deducted from your income.

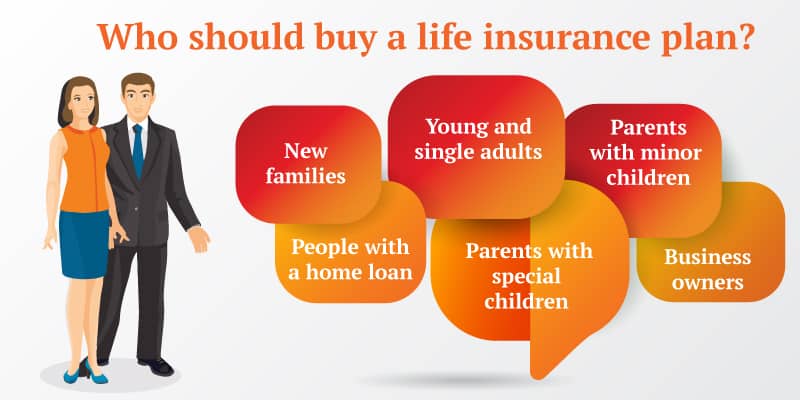

I’d tell you how to choose life insurance that will best take care of your family, but are you even sure that you need it? It is important to decide whether you really need life insurance, because if you don’t, the money that will then be spent on monthly insurance premiums may have other better alternative spending areas which could profit you.

Don’t just listen to the insurance sales agents babble, because they’ll convince you to every possible point as to take the policy no matter what since they earn high commissions from the company for each sale they make. You’d have to consider a number of aspects and then decide if you really need it.

A single person with no liabilities, no debts, no credits, adequate consumption and a maintained savings account does not need life insurance at all. Some reasons why you might need it are for instance if you have a family depending on your income, you own a business, you need to cover any leftover debts or charges following your death such as funeral and burial costs, you need to cover federal taxes after your demise or you are just looking in investing somewhere and find higher returns by the insurance company.

Calculating the exact amount of the life insurance you need is pretty hard, but it may be appropriately calculated with the help of certain factors. Create a statement if you can or just total the probable expenses after your death on a piece of paper.

These include expenses such as discharge, burial, tax preparation and funeral costs, other sources of income such as spouse’s earning and social security refunds, financial debts or liabilities you leave behind, the number of dependents you have and their probable future expenses when you’re not here.

- What Is Aromatherapy Vs. What Are Essential Oils?

- What is La Tomatina in Bunol, Spain Like? What to Expect at the Famous Tomato Throwing Festival

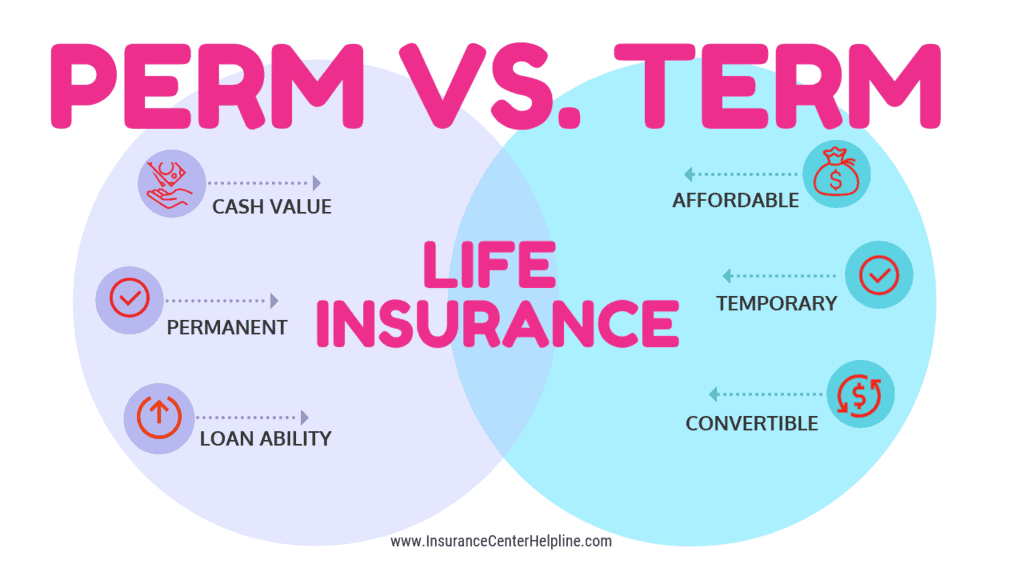

Now the thing that is the most confusing and previously even puzzled me, is what the types of life insurance are, how much do you need and which policy will best satisfy you and your family. The information part is not confusing, but the decision is quite hard to make when so many competitive options are available to you. There are basically 2 types of life insurances; permanent-life and term-life.

Permanent life insurance involves the payment of greater monthly premiums but it also gives a higher return and the policy never expires. It also has sub-types namely whole life, universal life and variable life insurance packages; different policies for different sets of people. Permanent life insurance is good for people who want permanent protection, their payments are stable and the ability to withdraw money against their policy on set terms.

Term life insurance on the other hand is a short-term investment and expires after an agreed period of time. Term life insurance is relatively cheaper and preferably for the fixed-income earning groups. It is important that you correctly select the proper type according to your own requirement; otherwise it would not be as profitable to you as it should be.

So, these were the life insurance basics. In a nutshell, analyze if you even do want an insurance policy. Your policy return should be enough to run your family’s day-to-day expenses after your death.

You are perfectly able to pay the relative insurance premiums each month from your salary without disturbing your monthly practices. Research well before purchasing the insurance policy that fits you best and not just from the first very company you visit; this is a serious matter. For a quick introduction, search through online life insurance quotes that can help you select a policy.

If you are unsure of anything or any matter that is somewhat complex/new to you, contact a financial adviser or a freelance insurance agent to help you on this matter. After your death, the last thing you want for your loved ones to handle is any kind of financial hardship; thus life insurance can make a great difference.